Key takeaways

- Manual Excel reconciliation is risky in the static GSTR-2B era, purpose-built tools raise match rates, cut cycle time, and protect ITC.

- Professional platforms combine exact and fuzzy matching across GSTIN, invoice number, date, values, and taxes, reducing false mismatches.

- Two-way missing invoice detection, ageing views, and vendor drill downs drive faster recovery of eligible ITC.

- End to end ITC claim optimisation requires eligibility tagging, deferral management, and strong alignment with GSTR-3B filing.

- Vendor follow up automation, with templates and SLAs, converts ad hoc chasing into a measurable workflow.

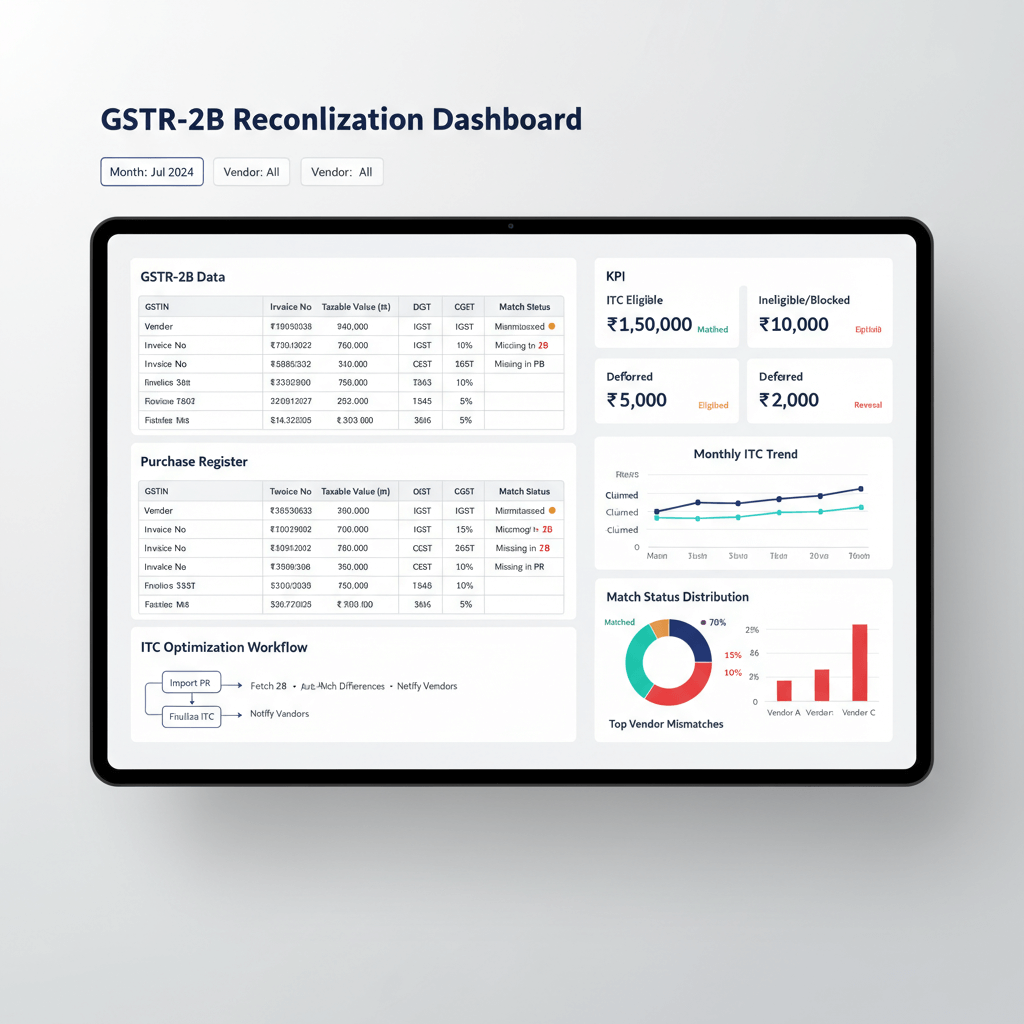

- Dashboards for partners and CFOs highlight eligible versus claimed ITC, vendor compliance, and trends across GSTINs.

- A structured seven day pilot validates matching accuracy, workflow depth, and integration with Tally or Zoho Books.

Opening: Month-End Pain Points and Why Tools Matter Now

It is the 8th of the month, you are juggling thousands of rows in Excel, a mismatch appears, and the scramble begins. Was it a typo, a late filing, or a carry forward from last month, hours go by with little clarity.

Manual reconciliation invites errors, slows vendor follow ups, and leaves ITC on the table. In today’s static GSTR-2B environment, provisional credit is curtailed, the 2B statement sets your ceiling, if an invoice is not present, you cannot claim it.

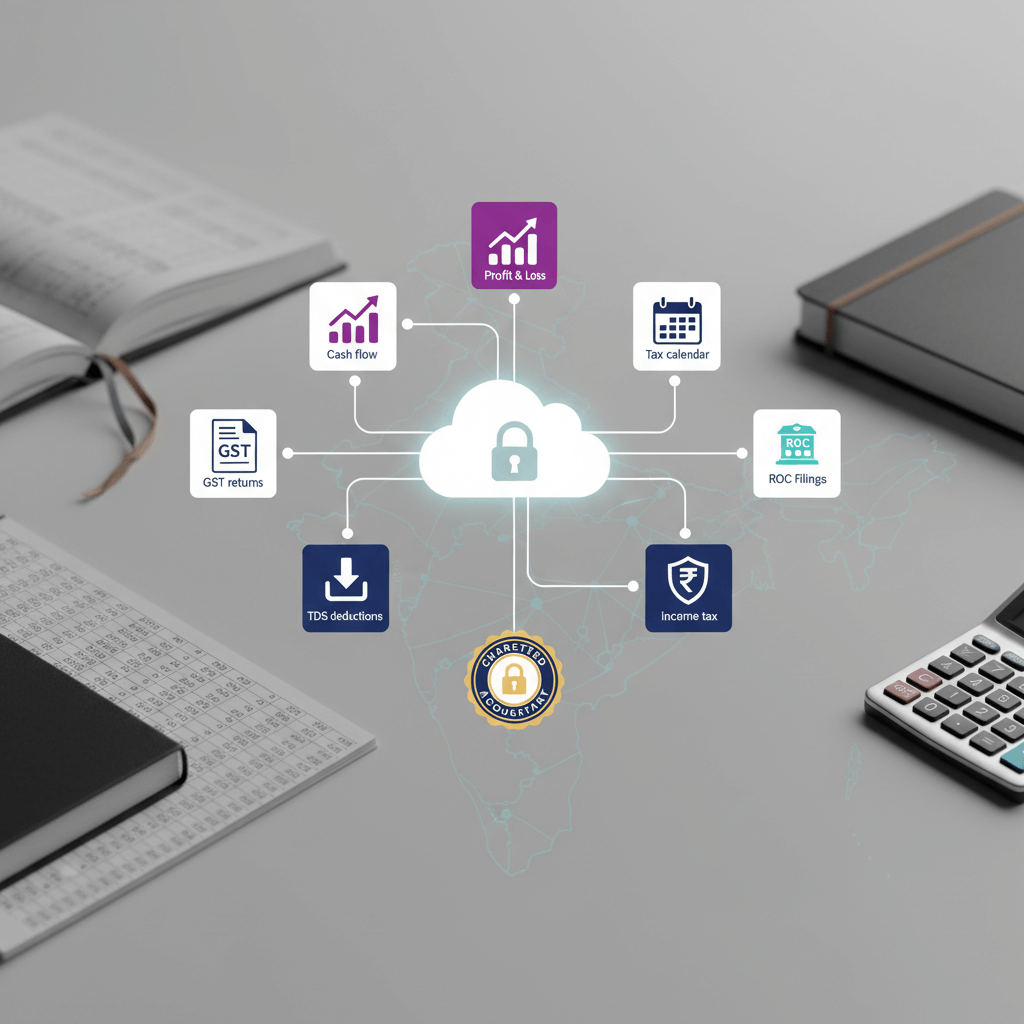

Modern platforms resolve this, they auto fetch GSTR-2B from the portal, ingest purchase registers, journal vouchers, credit and debit notes, then categorize every transaction as matched, mismatched, missing, ineligible, or deferred, complete with audit trails, notes, and exports. For a deep dive into this landscape, see the GSTR-2B reconciliation tools guide, TaxBuddy’s AI-based GST reconciliation, and Octa GST GSTR-2B reconciliation.

Think of a digital team member that never tires, never miscalculates, and processes thousands of invoices in minutes, not days.

Must-Have Capabilities in GSTR-2B Reconciliation Tools

Match Purchase Register

The core feature, matching, depends on layered logic, not just duplicates. Strong engines compare GSTIN, invoice number, date, taxable value, and tax breakups, then apply fuzzy rules for variations, with tolerance for rounding differences. They also resolve amendments, B2BA, credit and debit notes, RCM, imports with IGST, ISD credits, and composition suppliers, including cross period reconciliation. For patterns and real world examples, review the GSTR-2B reconciliation tools guide, TaxBuddy’s AI-based GST reconciliation, and Octa GST GSTR-2B reconciliation.

Example, your vendor labels an invoice as INV-2024-001 in books, but files it as INV2024001 on the portal, fuzzy matching spots it instantly.

Identify Missing Invoices

Two way detection is non negotiable, find invoices in books but not in GSTR-2B, and invoices in GSTR-2B but not in books. Useful views include ageing buckets, supplier drill downs, high value risk flags, and exportable lists for vendor outreach. Tools like Octa GST provide quick filters and side by side views that accelerate resolution. Explore best practices in the GSTR-2B reconciliation tools guide, TaxBuddy’s AI-based GST reconciliation, Octa GST GSTR-2B reconciliation, and this primer on GST reconciliation software and automation tool.

ITC Claim Optimisation

Maximising ITC means claiming the right amount at the right time, while staying compliant. Engines should auto tag eligibility, identify blocked credits, track the 180-day payment rule, and validate RCM and place of supply. Deferral management with reasons and audit trails helps you park ITC and bring it back later. Alignment with match GSTR-1 with GSTR-3B totals prevents under claims or over claims, and support for partial ITC plus apportionment handles complex scenarios. See real world approaches in the TaxBuddy AI reconciliation overview, the GSTR-2B tools guide, and the Tally focused GSTR-2B reconciliation tool guide.

Real win, a manufacturer discovered consistent under claiming on capital goods, the eligibility engine caught the pattern, unlocking substantial legitimate ITC.

Vendor Follow-Up Automation

Automated outreach replaces ad hoc chasing with templates, SLAs, and escalation rules. Multi channel reminders with invoice level detail, email plus WhatsApp, lift response rates, while compliance scorecards make discussions data driven. For workflows and examples, see the GSTR-2B reconciliation tools guide and Octa GST GSTR-2B reconciliation.

Sample reminder, Hi ABC Traders, we found a mismatch on Invoice 1234 dated 15 Oct 2024, taxable value ₹50,000, missing in our GSTR-2B. Please file or amend, reply with action taken.

Monthly Dashboard

Leaders need instant visibility, eligible versus claimed ITC, deferred amounts and ageing, top non compliant vendors, and month over month trends. For CA firms, multi organisation views and drill downs by GSTIN are essential, with PDF and Excel exports for client reviews. See the GST health check dashboard, the GSTR-2B tools guide, and Octa GST’s reconciliation solution.

Evaluation Checklist for CA Firms and SME Teams

Assess tools against your environment with a simple scorecard, insist on proof during demos, and avoid compromises on integration and security. For a broader market scan, compare insights from the GSTR-2B reconciliation tools guide, TaxBuddy AI reconciliation, BUSY GSTR reconciliation, Octa GST, the Tally centric complete GSTR-2B guide, and how to choose the best GST reconciliation software.

| Criteria | Must-Haves | Examples from Tools |

|---|---|---|

| Data Ingestion | PDF, Excel, CSV, scans, portal auto fetch, scale to 100,000 lines | AI Accountant enables GSTN auto fetch, TaxBuddy supports secure portal pull |

| Matching Engine | Configurable tolerance, fuzzy rules, cross month logic, fast processing | AI Accountant and TaxBuddy apply fuzzy logic |

| Workflow Depth | Approvals, notes, bulk operations, complete audit trail | Octa GST supports notes and overrides, AI Accountant provides exception workflows |

| Integrations | Native Tally and Zoho sync, push back clean data, APIs | AI Accountant offers native Tally and Zoho integrations |

| Security | ISO 27001, SOC 2 Type II, encryption, India data residency | AI Accountant highlights audited controls |

| Multi Org | Role based access, per GSTIN config, consolidated reporting | AI Accountant is designed for CA firms |

| Reporting | Real time dashboards, vendor scorecards, flexible exports | Octa GST and AI Accountant provide unified views |

| Support and Pricing | Onboarding assistance, SLAs, per GSTIN tiers, free trials | Varies by vendor, always test with a pilot |

Top GSTR-2B Reconciliation Tools for Different Needs

- AI Accountant, automation focused, native Zoho and Tally integration, multi org management for CA firms.

- TaxBuddy, early mismatch detection, secure portal pulls, AI driven insights.

- Octa GST, visual side by side views, strong vendor compliance analytics.

- BUSY GSTR reconciliation, configurable tolerance, good for straightforward needs.

- TallyPrime reconciliation guide, seamless for Tally users, limited advanced automation.

- Zoho Books GST, native GST features for Zoho users, basic reconciliation in upper tiers.

How AI Accountant Fits Without Heavy Pitch

The platform streamlines end to end reconciliation, ingesting purchase registers, journals, and credit or debit notes alongside GSTR-2B, then applying pattern recognition to resolve duplicates and cross period matches. Vendor management is automated with templates, SLAs, and escalation, while dashboards show live ITC positions, deferrals, and supplier compliance. CA firms benefit from multi organisation architecture and role based access, plus native Zoho Books and Tally sync for reliable push back of cleaned data. Security is a priority with audited controls. Learn more from the GSTR-2B reconciliation tools guide.

7-Day Pilot Plan

Day 1, Setup and Data Import

Connect Tally or Zoho Books, import two months of purchase data, and pull GSTR-2B from the portal, validate completeness.

Day 2, Configure Matching Rules

Set tolerance thresholds, map fields, run the first pass to match purchase register entries, gauge baseline match rates.

Day 3, Exception Management

Clean duplicates, tag deferrals with reasons, and identify missing invoices by value and ageing.

Day 4, Vendor Communication

Launch automated reminders with escalations, track responses and reopen unresolved items.

Day 5, ITC Validation

Align outcomes with GSTR-3B totals matching, validate ITC claim optimisation recommendations.

Day 6, Data Sync

Push reconciled data back to your books, compile audit trails and exception exports.

Day 7, Analysis and Decision

Review the monthly dashboard, quantify time saved, document pain points solved, and set KPIs for rollout. For checklists and comparisons, see the GSTR-2B tools guide, TaxBuddy AI reconciliation, and Octa GST.

ROI Model and KPIs

Time savings, 1,000 invoices that take 8 to 10 hours manually can be processed in minutes, at 5,000 invoices a month, firms often save 40 plus hours, worth ₹80,000 monthly at ₹2,000 per hour.

Error reduction, manual efforts show 2 to 3 percent error rates, automation typically reduces this under 0.1 percent.

ITC recovery, missing 1 to 2 percent of eligible ITC is common, on ₹1 crore of monthly purchases with 18 percent GST, recovering 1 percent yields ₹18,000 in additional credit.

KPIs to track:

- Match rate percentage, aim for 95 percent plus automated matches.

- Missing invoice value, reduce month over month.

- Eligible versus claimed variance, keep under 0.5 percent.

- Duplicate detection rate, a sign of improving data quality.

- Vendor compliance score, target steady improvement.

- Reconciliation cycle time, finish monthly close under four hours.

For benchmarks and context, review TaxBuddy’s AI reconciliation analysis, the GSTR-2B tools guide, and BUSY GSTR reconciliation.

Common Pitfalls and Fixes

Amendment and credit note misalignment, link amended documents to originals via cross period logic and keep a clear amendment register.

GSTIN errors and composition dealers, use fuzzy matching on vendor names alongside GSTIN, flag composition dealers separately.

Round off differences, configure tolerance, often ₹1 to ₹2, and standardise rounding rules.

RCM and import complications, ensure built in RCM categorisation and separate IGST on imports from regular purchases.

ISD credits, maintain distinct ISD reconciliation and categorisation.

Over reliance on provisional ITC, treat GSTR-2B as the single source of truth.

Best practices:

- Clean vendor masters monthly, most mismatches start with poor masters.

- Run weekly mini reconciliations, smaller batches mean faster fixes.

- Document deferral policies, consistent reasons and timelines matter.

- Standardise vendor messages, clarity improves response rates.

- Monitor dashboards daily, early alerts avoid month end panic.

- Train teams on exceptions, tools automate routine work, judgment handles the rest.

Further reading, GSTR-2B reconciliation tools guide, TaxBuddy AI reconciliation, Octa GST solution, and the Tally oriented complete guide to ITC matching.

Moving Forward with Confidence

Shifting from spreadsheets to automated gstr 2b reconciliation tools transforms GST compliance from firefighting to a predictable process. Higher match rates reduce filing day surprises, cleaner books improve audit confidence, and safer claims lift cash flow. With time savings alone the platform pays for itself, add ITC recovery and error reduction for compelling ROI. Start with a structured evaluation and a one week pilot, then scale. For a quick primer and checklist, use the GSTR-2B reconciliation tools guide.

FAQ

How do gstr 2b reconciliation tools match purchase register with fuzzy rules and tolerance?

Modern engines layer exact matching on GSTIN, invoice number, date, taxable and tax amounts, then switch to fuzzy logic for variations like INV 001 versus INV001, or extra characters in invoice numbers. Tolerance controls handle rounding and minor value differences, for example ₹1 on small invoices or 0.1 percent on large ones. Tools learn over time, so vendor specific patterns become easier to match. AI Accountant uses machine learning on invoice patterns to improve accuracy with every cycle, see the GSTR-2B reconciliation tools guide and TaxBuddy’s AI-based GST reconciliation.

What is the best method to identify missing invoices across months without losing ITC?

Use two way detection, items in books but not in GSTR-2B, and items in GSTR-2B but not in books. Ageing buckets, 0 to 30, 31 to 60, 61 to 90, help prioritise follow ups. Supplier drill downs reveal habitual late filers or GSTIN issues. Exportable lists ensure vendor outreach and audit evidence. AI Accountant and similar tools generate vendor wise packs in minutes, more in the tools guide and this overview of GST reconciliation automation.

How should a CA structure an ITC claim optimisation workflow end to end?

Start with automated eligibility tagging, blocked credits, place of supply, RCM, then track the 180-day payment rule for reversals and reclaims. Add deferral management with reasons and audit trails, then align with GSTR-3B totals matching to avoid under or over claims. For Tally shops, see the complete GSTR-2B guide. AI Accountant implements this flow with eligibility engines, deferrals, and 3B alignment out of the box.

How do I set up vendor follow up automation and measure compliance scientifically?

Configure templates that include invoice numbers, dates, taxable values, and ask for specific actions, then set SLAs and escalations by value and ageing. Use email for documentation and WhatsApp for quick nudges. Measure vendor wise filing accuracy, response times, and trends. AI Accountant provides compliance scorecards and one click reminder packs, see the tools guide and Octa GST solution.

Which dashboard views should partners and CFOs see during close?

Show eligible versus claimed ITC as the headline metric, missing invoice value by bucket, top non compliant suppliers, and month over month trend lines. For CA firms, add multi org views with drill downs by GSTIN and supplier. Exports to PDF for meetings and Excel for analysis are essential. Reference the GST health check dashboard and Octa GST reconciliation.

How do tools handle amendments, credit notes, and cross period adjustments correctly?

Accurate systems link B2B and B2BA records, pair credit or debit notes to originals, and reconcile across months when invoices shift periods. They maintain an amendment register, avoid double counting, and present a clean audit trail. AI Accountant’s matching engine uses reference mapping and fuzzy rules to stitch timelines together reliably.

What tolerance settings should I start with for amount differences and rounding?

Begin with ₹1 to ₹2 for absolute rounding differences on small invoices, and 0.1 percent on larger documents, then tune based on supplier behaviour. Keep separate tolerance for tax components if needed. Document the policy in your audit playbook and replicate settings across client GSTINs for consistency. AI Accountant allows per GSTIN tolerance profiles, which is useful for CA firms.

How do I reconcile RCM, imports with IGST, and ISD credits without creating noise?

Use category aware ingestion and matching, RCM purchase entries should be separated from supplier invoices, IGST on imports should be tracked via BOE references, ISD credits should flow into a distinct reconciliation view. Good systems auto classify these, then present focused exception lists. AI Accountant and BUSY provide separate RCM and ISD buckets, see BUSY GSTR reconciliation for a reference.

What KPIs should a CA firm present to clients to prove impact of automation?

Report automated match rate, missing invoice value trend, eligible versus claimed variance, duplicates detected, vendor compliance score, and reconciliation cycle time. Add recovered ITC from past periods to highlight cash impact. AI Accountant’s dashboard aggregates these KPIs and exports monthly packs in a few clicks.

How can I run a low risk pilot before full rollout across GSTINs?

Adopt a seven day plan, connect one GSTIN, import two months, run baseline matching, clean exceptions, automate vendor reminders, align with GSTR-3B, push data back, then review dashboard metrics and time saved. This validates accuracy and workflow fit quickly. Use checklists from the GSTR-2B tools guide and compare with TaxBuddy’s AI reconciliation.

Is Tally or Zoho Books integration truly bi directional for reconciled data?

Look for native connectors that support scheduled pulls, field mapping, and push back of cleaned vendor and invoice data. CSV shuttling adds risk and slows the month end. AI Accountant provides native Tally and Zoho connectors so reconciled records sync directly, reducing manual intervention.

How do I quantify ROI for management approval on gstr reconciliation software?

Combine time saved, error reduction, and ITC recovered, then compare against license cost per GSTIN. For example, 40 hours saved monthly at ₹2,000 per hour equals ₹80,000, add recovered ITC and fewer notices for a conservative business case. Track results on the dashboard for three months to validate your assumptions, and iterate settings for greater gains.

-01%201.svg)