Key takeaways

Introduction to Accounting Solutions for SMBs

If you lead a small or mid sized business, you juggle sales, cash, vendors, and tax. It is easy for books to slip. Accounting solutions for SMBs help you keep records clean, stay compliant with GST and TDS, and see your cash flow in real time.

In this guide, we walk through the full landscape. You will see what to expect from software and services. You will learn how to pick, set up, and scale the right fit. We also explain how a CA led virtual accounting service like AI Accountant blends a managed model with a live dashboard for steady results.

A simple process, plus automation and a compliance calendar, usually beats ad hoc fixes and last minute rush.

Further reading for context, Meru Accounting overview, Giddh software roundup, BUSY accounting software.

What SMBs Need from Accounting Solutions, GST, TDS, and Cash Flow

Your business needs a few core outcomes. They are simple to state, yet hard to achieve without structure.

To get there, look for the following must haves.

Resources, IBNTech on small business software, Giddh list of options, Meru Accounting services.

Types of Accounting Solutions for SMBs, Pros and Cons

DIY spreadsheets

Free and flexible for basic tracking, but error prone, no automation, weak compliance, and not scalable beyond very small volume.

Cloud accounting software

Tools like TallyPrime, Zoho Books, Giddh, QuickBooks, and BUSY offer GST ready invoicing, bank feeds, and real time reports at friendly prices, usually from about two thousand to eighteen thousand rupees per year. TallyPrime is strong for multi currency and custom reports, Giddh and BUSY support e invoicing and TDS and TCS. Limits remain, you still need expertise for TDS or ROC filings, automation is partial, advisory is limited.

In house accountant or team

Full control and custom processes, good for on site coordination. Downsides are higher salary cost, hiring and retention risk, turnover disruption to MIS and close.

Outsourced CA firms

GST, TDS, and income tax handled well, tax audit prep included, yet work can get fragmented across email and chat, often with no shared live dashboard, variable response times.

Virtual accounting services

CA led managed service with a dashboard, end to end execution and a compliance calendar, AI alerts, and centralized access to data and documents. Ongoing fees are higher than software, and you depend on provider service levels. When run well, this is the most complete model for SMBs.

Hybrid approaches

Use internal software for daily work and a CA for filings, balanced cost and expertise, with coordination overhead you must manage.

Popular tools to explore

Compare more options, Giddh guide, Indeed list, BUSY features, Tally solutions, Meru Accounting.

Key Features to Look For in Accounting Solutions for SMBs

Bookkeeping automation

Automated invoicing, expense capture from bills and receipts, bank reconciliation via bank feeds, and payment gateway integrations. Auto matching saves hours and reduces errors.

Chart of accounts and ledger clean up

Standardize the chart, remove duplicates, and clean ledgers for accurate and audit friendly reports.

Inventory and fixed assets

Stock tracking with item master and HSN codes and landed cost logic, fixed asset register with depreciation schedules.

Accounts receivable and accounts payable

Track DSO and DPO, automate reminders, use aging reports, tie to collections and vendor payment runs.

Cash flow and MIS reporting

Dashboards for cash in and out trends, burn rate, and runway, plus MIS packs for profit and loss, balance sheet, and variance analysis. See examples, cash flow and runway.

GST tools

GSTR 1 and 3B filing support, annual returns like 9 and 9C, e invoicing, and book to return reconciliation. Watch place of supply and reverse charge.

TDS and income tax

Support TDS calculation, challan payment, filings like 26Q, 24Q, and 27Q, plan advance tax, file for individuals, partnerships, and companies. Reference, TDS and income tax services.

ROC and MCA for small companies

For small companies with turnover under one hundred crore and paid up capital under ten crore, ensure MGT 7, AOC 4, DIR 3 KYC, and event filings. See overview, ROC and secretarial support.

AI alerts and compliance calendar

Use AI to flag anomalies and run a compliance calendar with reminders that prevent fines.

Secure document repository

Store invoices, contracts, and working papers centrally with role based access and audit trails.

More feature lists, IBNTech, Indeed, Meru, Giddh, BUSY.

Compliance Landscape for SMBs in India, GST, TDS, ROC

GST

File GSTR 1 and GSTR 3B monthly or quarterly based on your scheme, annual returns include 9 and sometimes 9C. Common pitfalls, place of supply errors, reverse charge, and wrong HSN. E invoicing is mandatory for many, track your threshold and enable on time.

TDS

Deduct at the right rate, pay the challan, and file quarterly returns. Forms include 26Q for non salaries, 24Q for salaries, 27Q for non residents. Reconcile with 26AS to avoid notices.

Income tax

File annual returns, consider tax audit if turnover is above ten crore or for professionals above two crore. Keep ledgers and schedules ready so audit prep is smooth.

ROC and MCA

Small companies must file MGT 7 and AOC 4 and manage event filings for board matters and AGMs. Penalties can be steep, late GST can attract eighteen percent interest, timeliness matters.

Sample compliance calendar: imagine a monthly grid, 3B due by twentieth, 1 by eleventh or quarterly, TDS challan by seventh, TDS return by thirtieth, ITR like ITR 4 by July thirty one, green when done, amber when due, red when overdue, alerts one week prior.

Sources, Meru Accounting, Giddh.

Implementation Roadmap for SMBs, Clean Up, Setup, and Go Live

Step one, assess current state

Review books quality, compliance gaps, current GST and TDS status, notices, bank reconciliations, and aging.

Step two, clean up

Ledger scrutiny, normalize chart of accounts, fix opening balances, complete historical bank and gateway reconciliations, resolve old unmatched entries.

Step three, setup and integrations

Connect bank feeds, integrate gateways and payroll, enable e invoicing if applicable, configure user roles and access.

Step four, process design

Create a month end checklist for cutoff, postings, accruals, reconciliations, and review, set the compliance calendar, define owners and timelines.

Step five, MIS cadence

Define dashboards and reports, weekly cash review, monthly MIS with variance against plan, fix the format and delivery date.

Step six, governance

Quarterly health checks, team training, updated document repository, a standing review of open issues.

Onboarding template

Reference, Meru Accounting rollout.

Measuring ROI of Accounting Solutions for SMBs, KPIs and Wins

Expect twenty to fifty percent time savings over twelve to twenty four months, faster collections, and lender or investor readiness with current MIS and audit ready books. See more, Meru Accounting.

Common Pitfalls and How to Avoid Them

Over reliance on spreadsheets

Spreadsheets get messy as volume rises and do not enforce GST rules, move to GST compliant software to cut errors and speed filing.

Missed deadlines

Manual reminders fail, use an automated compliance calendar and shared dashboard visibility.

Weak reconciliations

Without bank and gateway feeds, unreconciled entries pile up, prioritize integrations, reconcile weekly, lock prior periods.

Non scalable tools

Plan for multi currency, branches, and custom reports early, evaluate TallyPrime or similar if complexity is rising.

Poor security

Demand role based access, audit trails, and backups to reduce audit risk and staff transition risk.

Learn more, Giddh guide, IBNTech, BUSY, Tally, Meru.

Solution Comparison, Cost, Control, and Visibility

DIY software and spreadsheets are lowest cost, yet lack TDS depth and compliance workflows. An in house team gives control, at higher expense and staffing risk. Traditional CA firms ensure filings, often without real time visibility. Virtual accounting that blends a CA led service and a live dashboard stands out, you get real time MIS, clear accountability, and scalability.

Total cost of ownership: software alone may cost around twenty thousand rupees per year, a virtual model may range from ten thousand to fifty thousand rupees per month based on scope. Despite a higher monthly fee, ROI is strong when you avoid penalties, speed close, and make better cash calls. Sources, Meru Accounting, Giddh.

How CA Led Virtual Accounting Solves for SMBs, End to End with a Dashboard

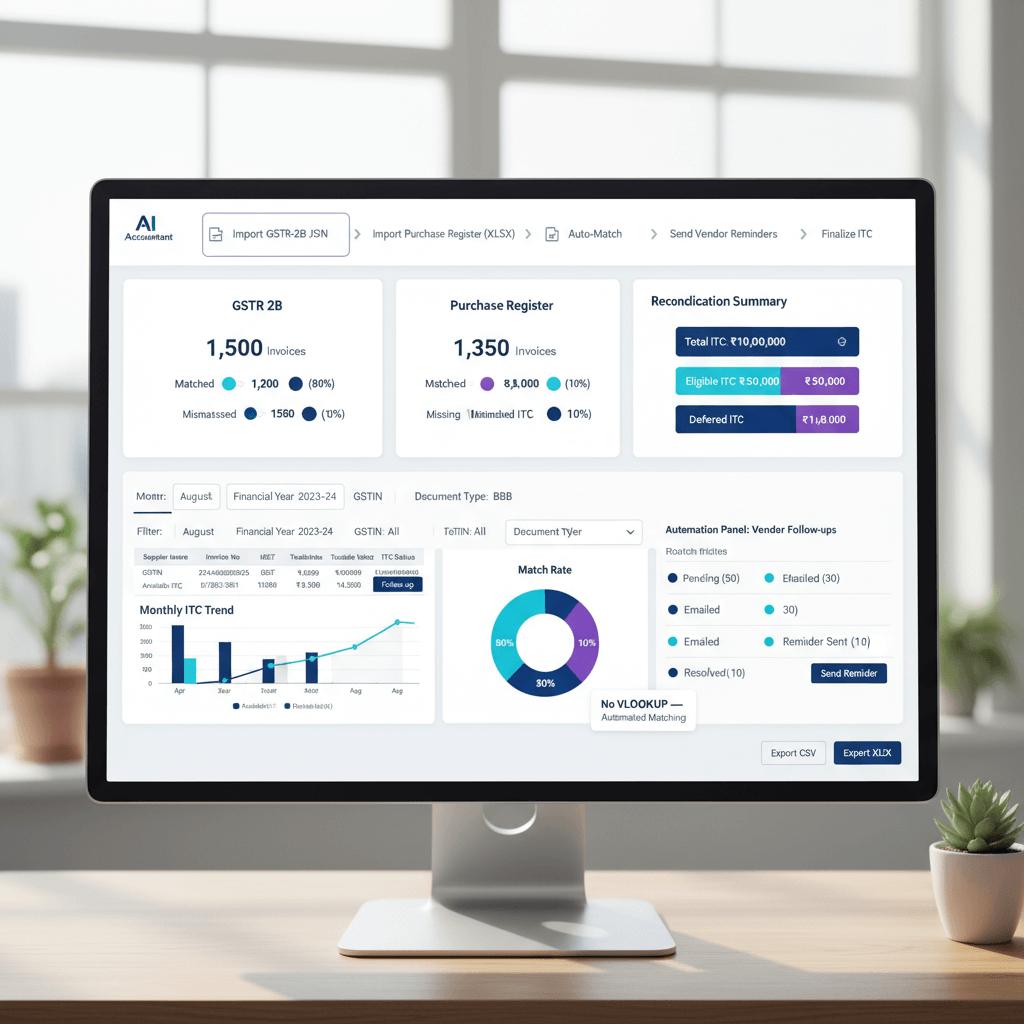

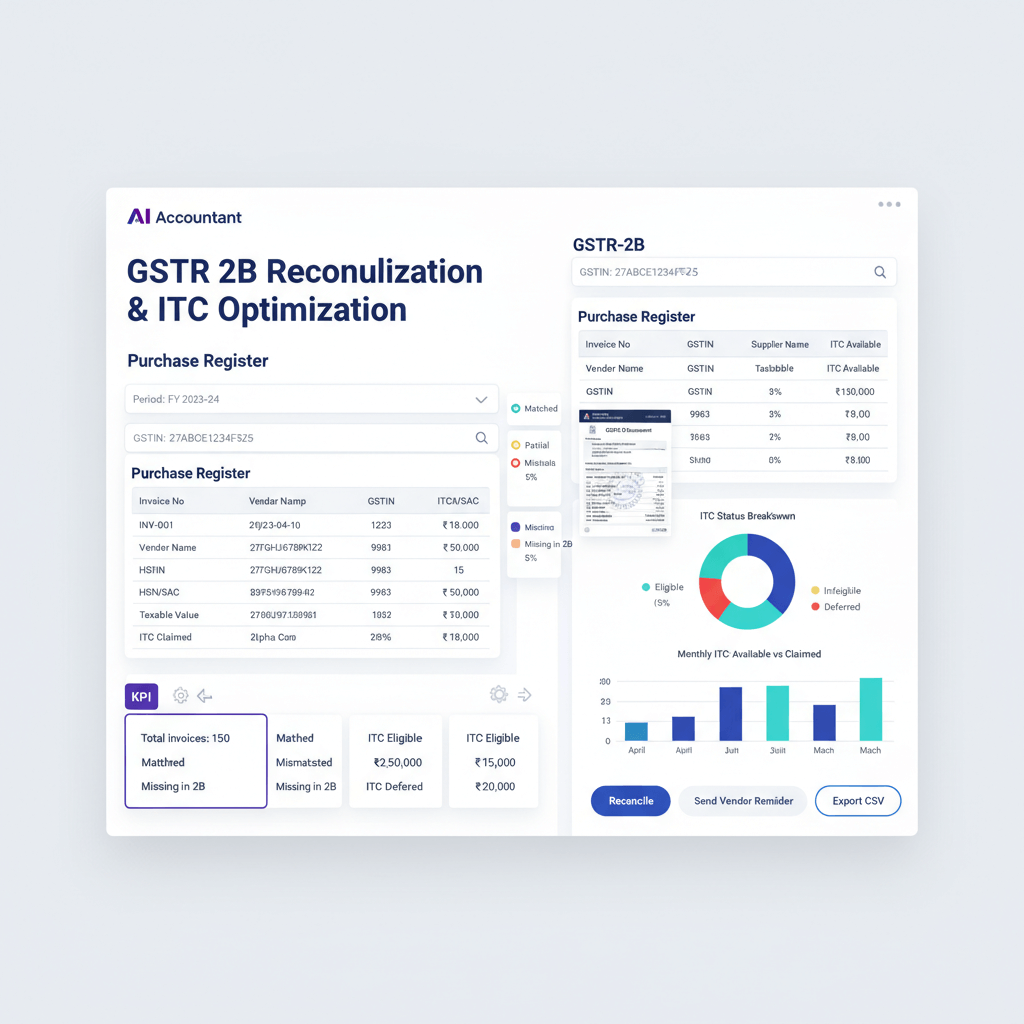

A CA led virtual accounting service brings people, process, and platform together. AI Accountant exemplifies this model with a dedicated CA team and a proprietary dashboard.

Managed coverage includes:

The dashboard: financial overview for revenue and expenses and profit and loss and balances, category breakdowns, cash trends and burn and runway, AI insights and alerts, recent transactions and bank analysis, secure document repository, live compliance calendar with status, a single communication thread with the CA team.

Outcome: discipline without hiring a full team, one place for numbers and documents and compliance, monthly deliverables like reconciled books, GST filings, and MIS packs by a fixed date such as the seventh working day.

More on managed models, Meru Accounting.

Use Cases, Real Results

Startup case

A growing startup had DSO near sixty days. With a CA led virtual accounting model, dashboards and AR workflows automated reminders, disputes were cleared faster, DSO dropped to thirty days. Compliance hit one hundred percent on time due to the compliance calendar and alerts.

Established SMB case

An established business had slow close and notices for mismatched filings. Structured reconciliations and quarterly health checks reduced close time by about seventy percent, while avoiding around two lakh rupees in penalties across the year.

Background reading, Meru Accounting.

Checklist for Choosing Accounting Solutions

See also, Meru Accounting.

Closing Thoughts

Strong accounting is not just for audits, it powers daily decisions. Pick the right solution, get clean books, on time GST and TDS, and a clear view of cash.

If you want end to end execution with a single dashboard, consider a CA led virtual accounting model. AI Accountant pairs a dedicated CA team with a live system so you can see numbers, documents, and compliance status in one place. It replaces scattered workflows with a managed process that scales. Ready to explore, map your needs, review the checklist, and request a demo or a CA consultation, a little effort now saves time, money, and stress all year.

FAQ

What is the difference between bookkeeping and compliance for an SMB in India

Bookkeeping records sales, purchases, expenses, assets, and bank movements into ledgers, compliance applies laws like GST filings, TDS deductions and returns, and income tax filings, both are essential for accuracy and risk control.

How do GST and TDS workflows embed into day to day operations

GST flows through invoicing and purchase postings and reconciliations, TDS is deducted on eligible payments at disbursement, then challans are deposited and quarterly returns are filed, a compliance calendar keeps the sequence on time.

What are typical costs for SMB accounting, software versus virtual accounting

Software licenses often range from two thousand to twenty thousand rupees per year, a CA led virtual accounting engagement can start near fifteen thousand rupees per month and scale with scope, many firms choose a managed plan when compliance breadth and MIS cadence matter.

How safe is my financial and statutory data in a virtual accounting model

Insist on role based access, audit trails, and cloud backups, ask about encryption and data residency, restrict bank data and return access to need to know users, AI Accountant enforces maker checker and maintains an audit log for every filing event.

How fast can we implement a CA led virtual accounting setup from messy books

Clean books can go live in four to six weeks, if heavy clean up is needed, allow extra cycles for ledger normalization and historical reconciliations, AI Accountant commonly uses a four week onboarding template with a supervised first close.

Can virtual accounting handle multi GSTIN, multi branch, and e invoicing thresholds

Yes, ensure the solution supports multiple GSTIN profiles, place of supply logic, and IRN generation, AI Accountant configures branch wise series and automates 2B reconciliation to keep input tax credit clean.

How are TDS rates, 206AB checks, and PAN or Aadhaar validation handled automatically

Modern systems maintain rate masters and apply 206AB higher rate checks for non filers, they validate PAN or Aadhaar in vendor masters, AI Accountant auto flags exceptions before payment runs, then posts challans and files 24Q, 26Q, and 27Q on time.

What SLAs should a founder or finance head demand for month end close and filings

Common SLAs include books reconciled by the seventh working day, GSTR 1 and 3B filed on due dates, TDS challan by the seventh and quarterly returns by the thirtieth, AI Accountant publishes SLA compliance on the dashboard with green or amber or red status.

How do you resolve GST input mismatches between books and GSTR 2B without last minute rush

Run a weekly 2B reconciliation, send vendor nudges for missing invoices, apply hold and release in AP, AI Accountant uses AI alerts and vendor scorecards to reduce surprises by month end.

Can a virtual accounting provider coordinate with our statutory auditor and lenders during audit or loan processing

Yes, the team prepares schedules, ledger extracts, confirmations, and aging reports, then routes auditor queries in a single thread, AI Accountant maintains a secure repository for working papers and provides lender ready MIS packs.

How does AI Accountant integrate with TallyPrime or Zoho Books that we already use

AI Accountant can operate on your existing stack, for TallyPrime it uses data import or ODBC connectors, for Zoho Books it uses APIs for invoices, payments, and bank feeds, the dashboard consolidates KPIs and compliance status regardless of the underlying ledger.

What is the data ownership and exit plan if we switch providers later

You retain full ownership of ledgers, documents, and returns, demand periodic exports in standard formats and a final handover pack, AI Accountant includes data export and a closeout checklist in its engagement terms.

How do you manage maker checker controls and payment approvals in a virtual workflow

Define roles for preparation and review, lock prior periods, and separate posting from payment initiation, AI Accountant integrates approval gates and keeps an audit trail for every exception, change, and approval.

Which KPIs should a CFO track monthly to verify ROI from virtual accounting

Track SLA adherence, unreconciled items count, invoice to cash cycle time, DSO and DPO, error rates, penalty incidence, and cash forecast accuracy, a steady downward trend in exceptions and close time signals strong ROI.

Further references, Meru Accounting, Giddh, BUSY.

-01%201.svg)