Key takeaways

- QA in bookkeeping is a structured safety net that reduces errors, improves compliance, and speeds month end close for Indian SMBs.

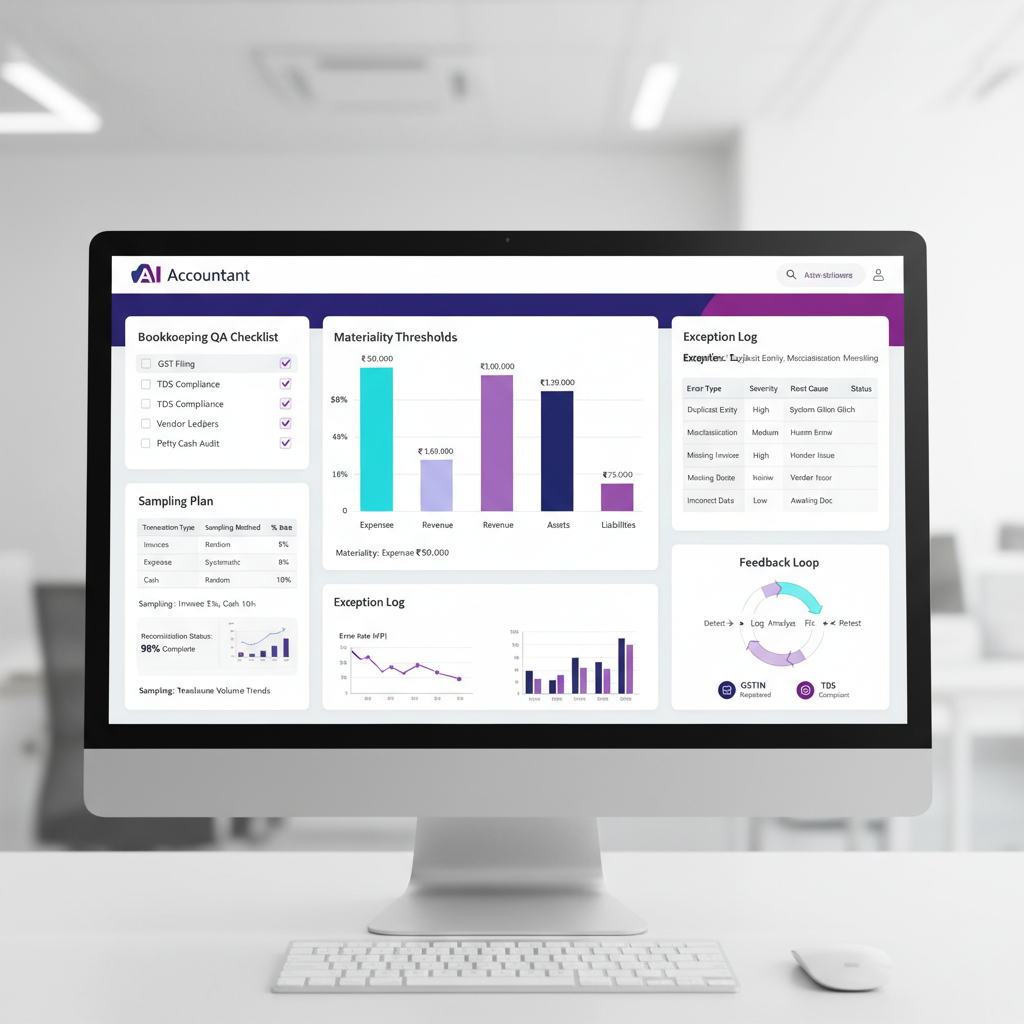

- Materiality thresholds, sampling plans, standardized reviewer checklists, and clear exception logs form the backbone of an effective QA program.

- Risk based and statistical sampling together give coverage where it matters most, while keeping workload manageable.

- Exception logging with SLAs, root cause codes, and ownership turns findings into action, not just notes.

- Feedback loops, standard comment codes, and targeted training lift preparer accuracy over time.

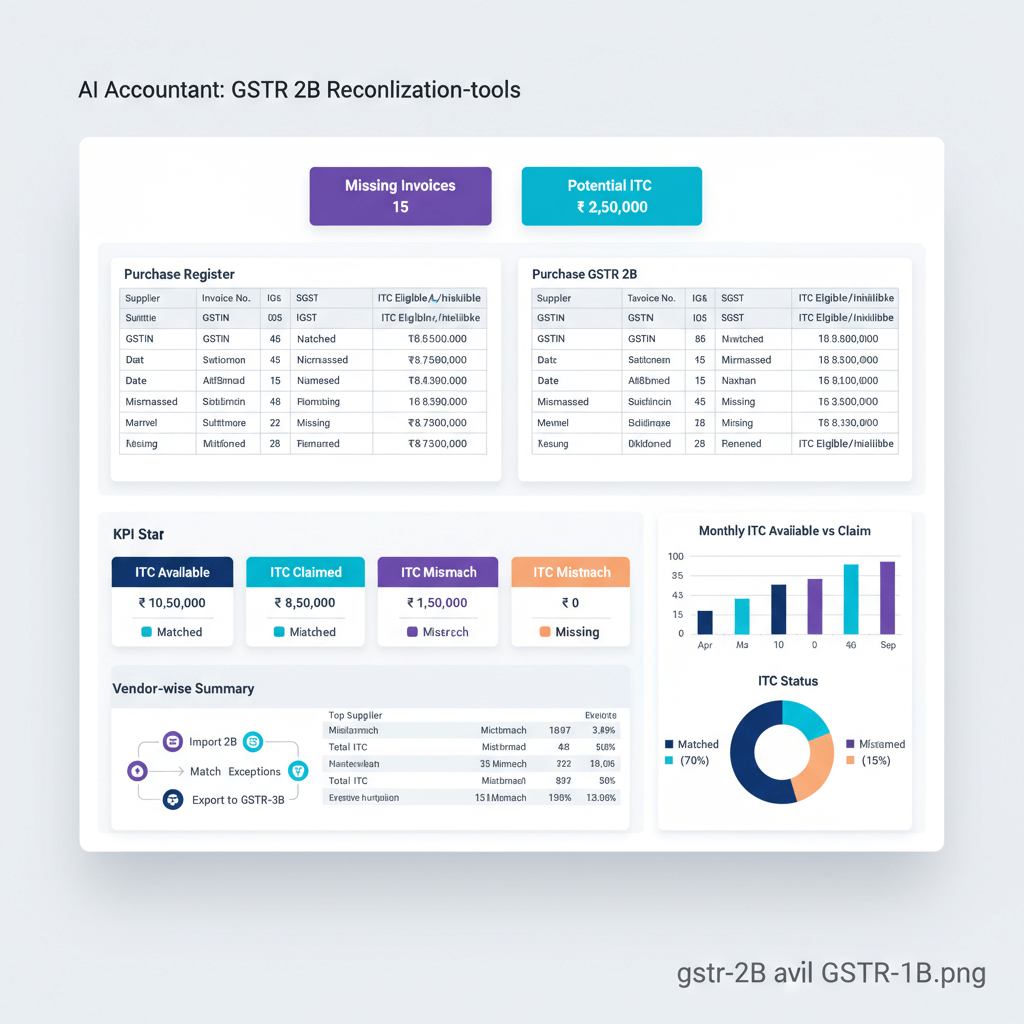

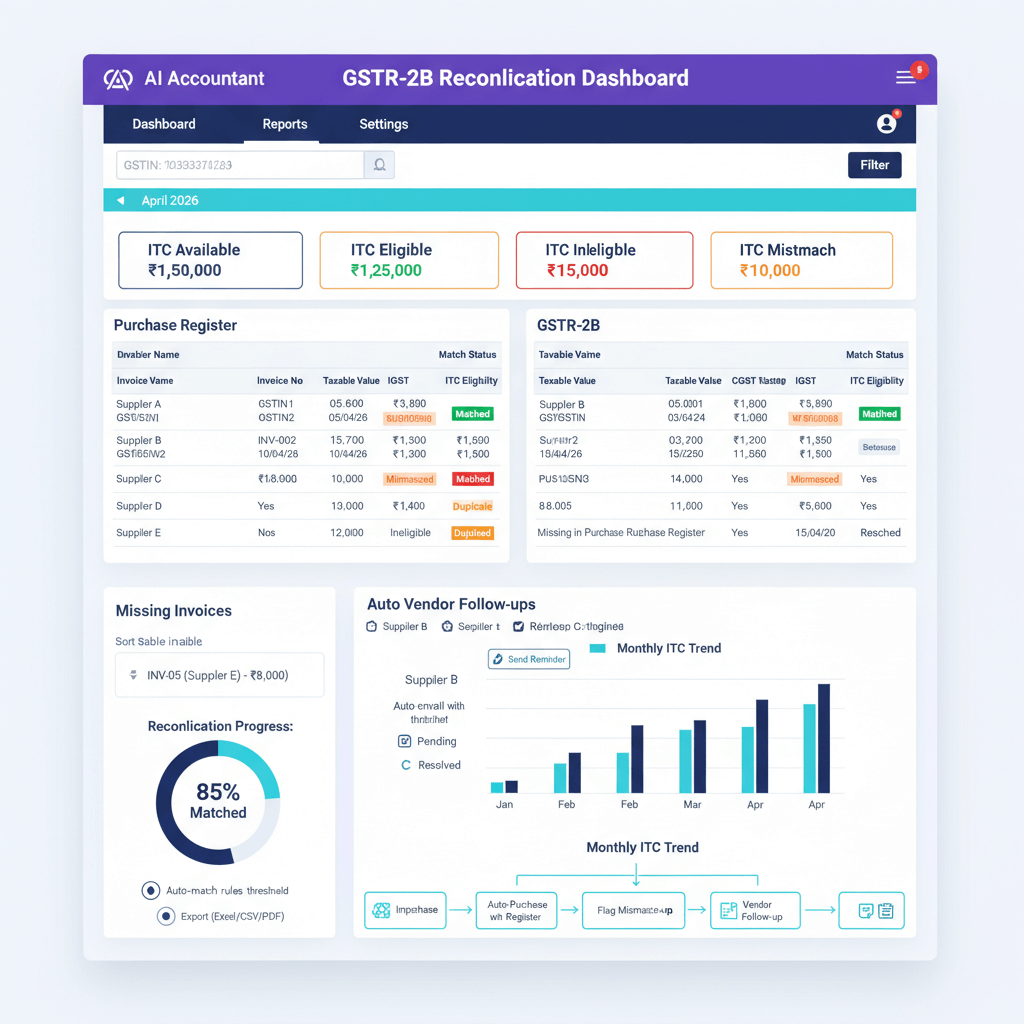

- Tools such as AI Accountant automate ingestion and reconciliation, freeing reviewers to focus on judgment, not data entry.

Introduction, understanding QA in bookkeeping

Quality Assurance in bookkeeping is the second pair of eyes every finance team needs. It is the discipline that ensures every transaction, every ledger, and every compliance task is accurate, complete, and review ready. For Indian SMBs juggling GST, TDS, multiple bank formats, and high transaction volumes, QA is not optional, it is essential.

QA catches what your first pass misses, before it becomes a compliance headache or a cash flow surprise.

Why QA in bookkeeping matters for Indian SMBs

Indian businesses deal with GST reconciliations, TDS deductions, and heterogenous bank statements. Without structured QA, small errors compound, a wrong GST code today becomes a mismatch in tomorrow’s GSTR filing, an unreconciled bank entry becomes next month’s cash flow mystery. Strong QA delivers accuracy at scale, supports India specific compliance, reduces post close adjustments, and shortens your close.

The India specific context

Teams work in Tally or Zoho Books, manage bank statement formats from HDFC, SBI, and ICICI, track multiple GST rates and HSN codes. Generic QA frameworks fall short. You need India aware controls such as GSTR 2B matching, TDS verification, and document driven workflows that reflect local realities.

AI as your quiet assistant

Modern tools can shoulder the grunt work. Solutions like AI Accountant can automate data ingestion and ledger mapping, flag anomalies early, and prepare clean review queues. Reviewers then focus on judgment and compliance, not manual data checks.

Automation prepares, humans decide.

What a QA program covers

A clear scope avoids gaps. Include bank reconciliations, vendor and customer ledgers, GST coding accuracy, accruals, AP and AR ageing, invoice to bill matching, cash and loan entries, and cross module ties such as inventory to COGS.

Defining roles and responsibilities

Clarity prevents confusion. Preparers enter and classify, reviewers verify accuracy and compliance, approvers sign off. Keep a simple RACI so everyone stays in lane.

Setting the right cadence

Weekly transaction checks catch errors early, monthly reconciliations ensure clean close, quarterly deep dives surface systemic fixes. Cadence balances speed and quality.

Materiality thresholds

Materiality keeps effort focused on what matters. Overall materiality often sits at 5 percent of monthly profit, or 0.5 to 1 percent of monthly revenue. Performance materiality at roughly 75 percent of overall provides a buffer. Set tolerances by category, petty cash can allow 2 percent variance, high value vendor payments may allow just 0.5 percent, GST classification errors deserve zero tolerance.

Quantitative rules of thumb

For ₹50 lakh monthly revenue, overall materiality could be ₹50,000, performance materiality ₹37,500. Add absolute bands, under ₹1,000 light review, over ₹1 lakh full scrutiny. Adjust by risk and scale.

Qualitative considerations

Some small errors still matter, GST misclassification, repeated vendor miscoding, payroll anomalies. Factor these into your thresholds.

How thresholds guide your process

Thresholds size your samples, set checklist depth, and drive exception severity, ensuring material issues move first.

Sampling plan design

You cannot review everything, sampling gives confidence without overload.

Choosing your sampling approach

- Risk based, oversample new vendors, unusual amounts, manual journals, refunds, foreign exchange.

- Statistical, random for unbiased coverage, stratified by buckets, monetary unit sampling to weight large values.

Timing your samples

Pre close sampling three days before month end catches errors while fixes are easy. Post close sampling validates quality and informs next month. Rolling weekly samples cover high risk items continuously.

Practical example, 10,000 monthly transactions

Sample 100 random items, all 50 over ₹5 lakh, 200 from new vendors, 150 GST coded transactions. That is 500 total, comprehensive yet manageable. Tune by error rate and team capacity.

Working with Tally and Zoho

In Tally, pull by ledger group and export daybooks for random selection. In Zoho Books, use tags to mark samples. Use filters for high value or manual entries to build sampling frames.

How modern tools help

AI Accountant standardizes data from dozens of bank formats, providing clean sampling frames and fewer false positives.

Reviewer checklist

Consistency requires standards. A short, sharp checklist turns subjective reviews into repeatable controls.

Core checklist items

- Bank statement line matched

- Correct ledger selected

- GST code appropriate

- Vendor or customer name consistent

- Invoice or bill attached

- Amount matches supporting document

- Payment mode identified correctly

- TDS deducted if applicable

- Advance adjusted if relevant

- Foreign exchange rate applied correctly

- Expense category logical

- Cost center allocated

- Approval obtained for high value

- No duplicate entry

- Period allocation correct

Phrase checks as yes or no questions, add space for notes and a severity rating.

Integration with workflow tools

Upload, review, approve, and sync flows map neatly to these checks. AI Accountant can mirror each stage, ensuring nothing slips.

Exception logging

Findings matter only when tracked to closure. Use structured exception logging with SLAs.

What to log

Capture description, ledger, amount, materiality band, root cause, owner, due date, status, resolution notes, and evidence links. This supports pattern analysis and accountability.

Severity and SLA tiers

- Critical, over performance materiality, same day

- High, 50 to 100 percent of performance materiality, 48 hours

- Medium, 10 to 50 percent, one week

- Low, by month end

Root cause taxonomy

Standardize codes, data entry error, missing document, wrong GST code, duplicate entry, timing difference, unrecorded bank charge, integration issue. Consistency reveals where to train or automate.

Exception log template

Simple spreadsheet columns, ID, dates, description, amount, ledger, materiality, root cause, owner, due date, status, resolution notes, evidence, closed date. Sort by due date, filter by owner, review daily.

Feedback to preparers

QA becomes culture when feedback is timely and actionable.

Principles of effective feedback

Be prompt, be specific, be constructive, show evidence. Avoid vague comments, state the fix and the reason. For example, “Use 18 percent GST for this professional service as per rate schedule.”

Standard comment codes

Define shorthand such as CHK-01 for bank not matched, CHK-07 for wrong GST code. Codes speed communication and training.

Cadence and channels

Daily micro feedback through the exception log, weekly QA huddles for patterns, monthly retros for metrics and improvements.

Sample feedback messages

Missing document, “₹25,000 to ABC Vendors on 15th needs invoice attachment as per policy, upload and resubmit.”

GST error, “Service coded at 12 percent, should be 18 percent for professional services, revise and recalc.”

Duplicate, “Duplicate payment for INV-2345, original on 10th, duplicate on 12th, reverse duplicate and confirm single bank match.”

Training interventions

Track feedback by preparer, assign quick videos, one to one coaching, or formal courses where errors repeat. Prevention beats rework.

End to end workflow

Intake and structuring

Documents arrive via email, WhatsApp, portals, and paper. AI Accountant can ingest all sources, structure data, and prep it for review, reducing manual entry risk.

Applying thresholds and sampling

Flag high value items, generate risk based and statistical samples, and publish a review roadmap so reviewers know what to check, and how deep to go.

Executing reviews and logging exceptions

Work the checklist, log exceptions in real time, escalate unusual patterns even if a checklist box is ticked.

Approval and synchronization

Approve corrected items, then sync to Tally or Zoho Books to keep a single source of truth. Clean books feed dashboards and decisions.

Monthly close package

Include QA summary, exceptions found and closed, and a residual risk note. Stakeholders get confidence with evidence.

Metrics and KPIs

Defect density

Errors per 1,000 transactions, for example 15 errors in 3,000 reviewed equals 5 per thousand, trend it monthly.

Exception resolution rates

Track SLA compliance by severity, target 100 percent on critical, 90 percent on high, 80 percent on medium, 70 percent on low.

Preparer performance metrics

Rework rate and recurring exception types by preparer reveal training needs versus system fixes.

Sampling coverage

Compare planned versus actual samples, investigate gaps, and adjust future plans.

Compliance impact metrics

Measure GST and TDS mismatch rates, DSO and DPO changes, and forecast accuracy. These show QA value to leadership.

Case study

The baseline challenge

A CA firm serving 25 SMBs faced late reconciliations, GST code errors, and duplicate vendor bills. Teams were firefighting, closes were late, morale suffered.

Implementing QA

They set client specific materiality thresholds, built risk based samples, standardized checklists, and mandated exception logs with ownership. Daily feedback tightened the loop, AI Accountant reduced manual classification.

Measuring the results

In three months, post close adjustments fell 60 percent, manual classification dropped 75 percent, close time improved by two days, client satisfaction rose, and the firm onboarded new clients without adding headcount.

Tools and templates

Materiality threshold calculator

Spreadsheet with revenue, expense, profit inputs, overall and performance materiality, and category tolerances. Include risk presets.

Sampling plan template

Support risk based and statistical approaches, include population size, confidence level, expected error rate, calculated sample size, selection, status, and findings.

Reviewer checklist variants

Monthly close, weekly transactions, and vendor payment checklists. Keep versions under control to track improvements.

Exception logging spreadsheet

Use data validation for status and root cause fields, add pivots for quick analysis. Consider a task tool as volume scales.

Feedback comment codebook

Document codes, meanings, and examples, update quarterly based on patterns.

Common pitfalls and recommended tools

Common pitfalls to avoid

- Materiality set too low, noise drowns signal.

- Ignoring high risk categories like cash, FX, refunds, new vendors.

- Checklists misaligned with Tally or Zoho workflows.

- Exceptions without ownership or SLAs.

- Delayed or vague feedback that does not teach.

- Manual processes where automation exists.

Recommended accounting tools

- AI Accountant, automates bank processing, ledger mapping, and Tally or Zoho sync, reducing manual work while lifting accuracy.

- QuickBooks Online, cloud based accounting with strong reporting.

- Zoho Books, accounting with GST compliance for Indian SMBs.

- Tally Prime, deep GST and compliance capabilities.

- Xero, excellent bank reconciliation and integrations.

- FreshBooks, simple invoicing and expense tracking.

India specific considerations and future roadmap

GSTN integration opportunities

Auto fetch GSTR 2B and push GSTR 1 to reduce manual errors. Build QA checks to verify book entries match 2B, and sales match 1.

Account Aggregator framework

Direct bank feeds reduce data entry risk and speed reconciliation. Shift reviewer time from accuracy checks to classification and compliance.

AI powered reconciliation

AI driven anomaly detection and approval queues accelerate exception resolution. Your QA framework provides the guardrails.

Data security and compliance

Work with ISO 27001 and SOC 2 Type 2 certified partners, verify encryption and access controls, and document security checks within your QA.

Getting started, a four week implementation

Week 1, define thresholds and roles

Calculate materiality from recent financials, publish a RACI, align the team, and gather input.

Week 2, design sampling and checklist

Draft risk based and statistical sampling, build a crisp checklist, test on historical data, and refine.

Week 3, pilot

Run a limited scope pilot with real data, log exceptions, deliver daily feedback, capture lessons.

Week 4, launch and iterate

Roll out fully, monitor metrics daily in week one, tune thresholds and sample sizes, celebrate wins. Consider piloting AI Accountant for ingestion and mapping to cut grunt work.

Conclusion

QA in bookkeeping is not about perfection, it is about consistent, measurable improvement. For Indian SMBs, a disciplined QA framework reduces rework, speeds close, and builds confidence in the numbers. Start with thresholds, sampling, checklists, and exception logs, add tight feedback loops, then layer in automation. Regulations and tools will evolve, your QA should too, while keeping its purpose intact, ensuring accurate, complete, and reliable financial records.

FAQ

How should a CA set materiality thresholds for micro clients with low revenue volatility?

Use absolute amounts to avoid impractically small percentages. For revenue under ₹10 lakhs a month, set overall materiality at ₹5,000 to ₹10,000, performance materiality at roughly 75 percent of that. Apply zero tolerance for GST classification and statutory payments regardless of amount.

For a portfolio of 12 SMBs, what sampling mix is efficient for a two person review team?

Adopt a 40, 40, 20 split, 40 percent risk based, 40 percent monetary unit sampling, 20 percent pure random. Pre close review three days before month end, post close validation for a smaller back check. Use AI Accountant to pre clean bank data and auto tag anomalies.

What is a pragmatic RACI for a CA firm working in Tally and Zoho Books?

Preparers, junior accountants in charge of first pass entry and attachments. Reviewers, seniors validating checklists and logging exceptions. Approvers, partner or manager for final sign off. Clients, informed on critical exceptions and approvals above limits.

How do I tune tolerable error rates by category without overcomplicating controls?

Group into four bands, statutory zero tolerance, high value 0.5 percent tolerance, operational 1 percent, petty cash 2 percent. Review quarterly against observed error rates and adjust bands. Keep the policy to a single page for adoption.

What sampling frame should I use for new vendors and one time suppliers?

Treat them as high risk for three months, sample 100 percent above performance materiality, and 25 percent below it. Verify GST registration, TDS applicability, and invoice authenticity. Tools like AI Accountant can flag new vendor payments automatically.

How can I evidence QA to external auditors to reduce PBC requests?

Maintain a monthly QA pack, checklist completion logs, sample selections, exception logs with closures, and residual risk statements. Share your materiality policy and sampling methodology upfront, auditors often reduce duplicate testing when QA is robust.

What cadence works for bank reconciliations when using Account Aggregator feeds?

Daily light review for unmatched items, weekly focused review on aged unmatched lines, and full month end reconciliation. With cleaner feeds, shift effort to classification accuracy and documentation checks rather than basic matching.

How do I systematize feedback so preparers actually improve month over month?

Use standard comment codes, show three examples per code, and track code frequency by preparer. Run a 15 minute weekly huddle on top three patterns. Assign micro learning, for example a 5 minute video on GST code selection. AI Accountant can attach feedback at the transaction level for fast corrections.

What KPIs should a CA partner track to know QA is working across clients?

Defect density, SLA hit rate by severity, rework rate by preparer, planned versus actual sampling, GST or TDS mismatch rate, and close time. Trend these monthly and review outliers in a partner meeting.

How do I handle catch up bookkeeping for six months without drowning the team?

Stabilize the current month first to stop the bleed. For backlog, review all items above performance materiality, risk based sample the rest, and accept lighter QA for older, low risk months. Disclose a residual risk note for stakeholders.

When is it justified to move from spreadsheets to a workflow tool for exceptions?

When open exceptions exceed 50 across clients, or SLA breaches cross 10 percent in a month. At that point, adopt a task tool or a purpose built assistant like AI Accountant to auto create, assign, and track exceptions from reconciliations.

What does a good reviewer to preparer ratio look like for Indian SMB bookkeeping?

Commonly one reviewer to three preparers for steady state operations. For new client onboarding, tighten to one reviewer to two preparers for the first two cycles, then expand once error rates and exception volumes drop.

-01%201.svg)