TCS on Sale of Goods: Historical Rules, Rates, and Why It Was Removed

Tax Collected at Source (TCS) on the sale of goods was introduced under Section 206C(1H) of the Income Tax Act through the Finance Act 2020.

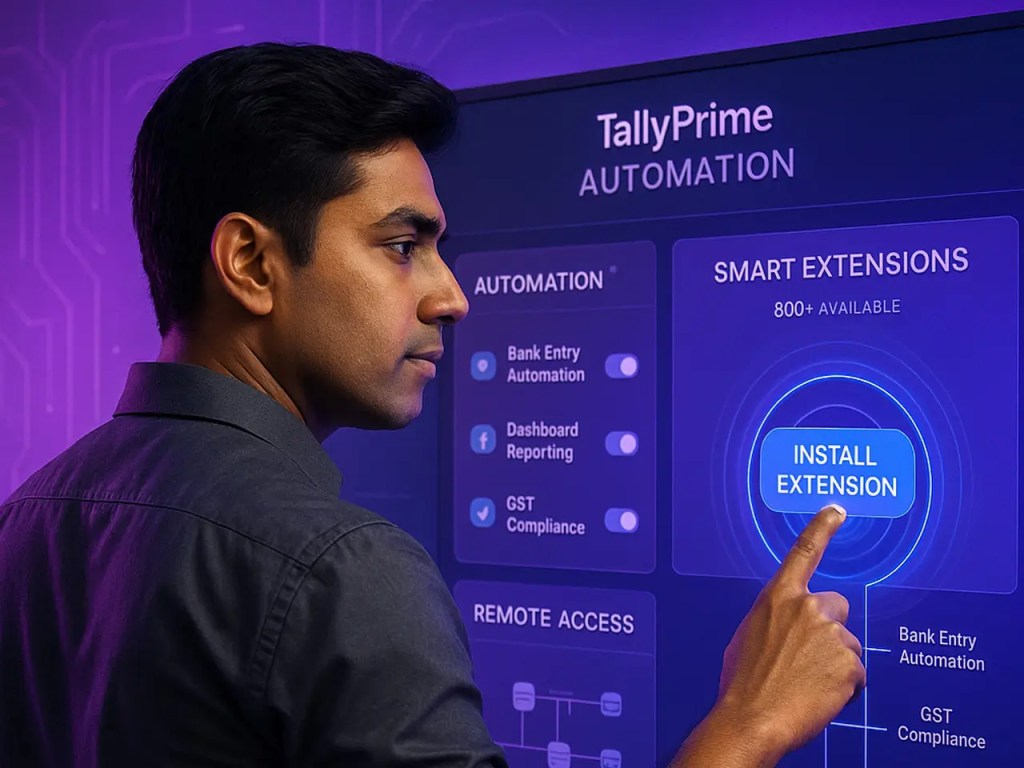

Comprehensive insights on automation, compliance, and scaling your CA practice with cutting-edge AI solutions and proven strategies.

Tax Collected at Source (TCS) on the sale of goods was introduced under Section 206C(1H) of the Income Tax Act through the Finance Act 2020.

Key takeaways Reduce delays at the source, standardize invoice intake, publish submission requirements, and lock a weekly payment run, these quick wins can cut follow-ups

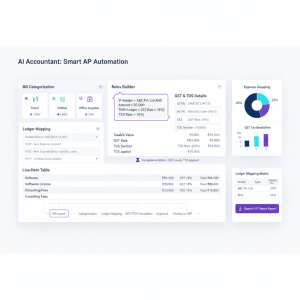

Key takeaways A clear bill categorization system, paired with India specific ledger mapping, turns messy bills into accurate ledgers, clean GST and TDS, and actionable

Key takeaways A 30 day sprint, done right, cuts 8 to 15 percent of operating expenses while protecting growth, and improves working capital by 10

Key takeaways Your startup finance stack India is an evolving ecosystem, it must handle GST, TDS, payroll, collections, investor reporting, and scale without constant rebuilds.

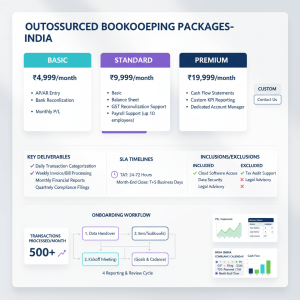

Key takeaways Clear monthly price bands for India delivery, Micro ₹8,000 to ₹15,000, Startup ₹15,000 to ₹35,000, Growth ₹35,000 to ₹75,000, Scale ₹75,000+, with add-ons

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.