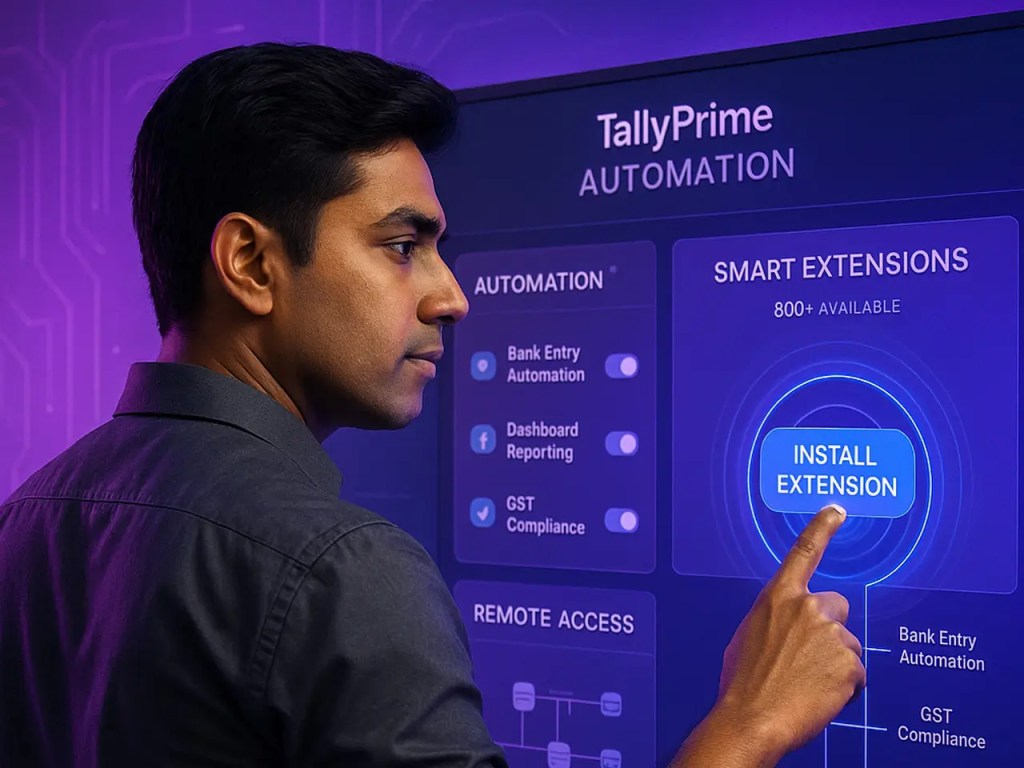

15 Best Accounting Software for Small Businesses in India (Free & Paid)

Running a small business in India today is more complex than ever. With all the requirements such as GST compliance, invoice management, vendor follow-ups, and

Comprehensive insights on automation, compliance, and scaling your CA practice with cutting-edge AI solutions and proven strategies.

Running a small business in India today is more complex than ever. With all the requirements such as GST compliance, invoice management, vendor follow-ups, and

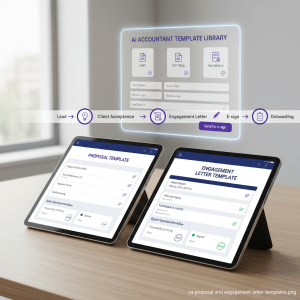

Key takeaways Use a clean, copy ready proposal template to convert prospects faster, ensure your engagement letter aligns with ICAI documentation standards, audit trail, and

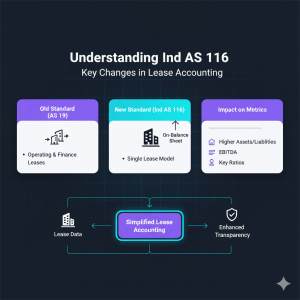

Ind AS 116, Leases, is the Indian Accounting Standard, that defines the principles relating to recognition, measurement, presentation, and disclosure of leases. The standard mandates

Professional Tax is one of many taxes that every business, professional, or employer must pay in India. It is a small but necessary tax that

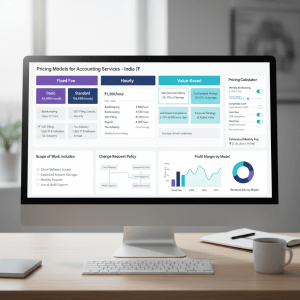

Key takeaways Use a hybrid model, fixed fee for predictable compliance, hourly for ad hoc and advisory, value based for strategic outcomes. Scope clarity is

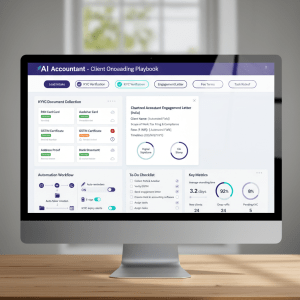

Key takeaways Automation removes drudgery from onboarding, it does not remove the human touch, freeing partners and managers to focus on advisory. Standardize every step,

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries.