Key takeaways

- Bank narration enrichment converts cryptic bank text into structured, usable data that feeds Tally or Zoho Books with minimal manual touch.

- Accurate GSTIN and PAN extraction, UTR or RRN decoding, and payer name standardisation dramatically lift match rates and audit readiness.

- Mode tagging for UPI, IMPS, NEFT, RTGS, NACH, charges, and refunds enables automated routing to the right ledgers and sharper analytics.

- With smart signals like amount, date windows, GSTIN, invoice hints, and confidence scoring, firms see 75 to 85 percent auto matching, sometimes higher.

- CA firms shift staff from data entry to exception handling, reduce cycle times, and improve GST compliance and documentation quality.

- Start with top volume accounts and top banks, measure baseline metrics, then scale once rules and parsers stabilize.

- Solutions like AI Accountant deliver India specific enrichment, end to end from OCR to posting, improving speed, accuracy, and audit trail depth.

Understanding Bank Narration Enrichment

Every morning, Indian accountants face narratives like UPI strings and NEFT references that slow reconciliation. This is where Bank narration enrichment does the heavy lifting. It transforms raw text such as “IMPS-987654321098-ACME CORP-REF45678” into clean fields, identifying mode, reference numbers, standardised payer names, and invoice hints, so your accounting stack can automate matches and postings.

The workflow is simple yet powerful. First, you ingest the statement via OCR or file import, then enrichment structures the data, then the enriched records post into Tally or Zoho Books with high confidence. The result is fewer keystrokes, faster closes, and a stronger audit trail.

Think of enrichment as a translator that speaks fluent bank statement and perfect accounting, bridging human readability and machine action.

The Core Components of Narration Enrichment

GSTIN and PAN Extraction

GSTIN extraction is foundational for India. The engine identifies the 15 character GSTIN pattern, validates the checksum, derives the embedded PAN, and links both to vendor masters. When it reads 27AABCU1234F1Z5, it confirms validity, extracts PAN AABCU1234F, and maps the entity to the correct ledger. This stabilizes GSTR-2B reconciliation and eliminates duplicate vendors across name variations.

- Checksum validation catches OCR errors, especially 0 or O and 1 or I confusions.

- PAN only cases route through a lookup to the primary GSTIN, with exceptions flagged.

- New vendors flow into a quick create queue for master setup.

UTR and RRN Decoding

Payment reference extraction converts references into traceable IDs. NEFT or RTGS use UTRs, IMPS or UPI use RRNs, card settlements use ARNs. These identifiers are your audit trail and dispute proof. Pattern recognition picks up bank codes, lengths, and numeric structures to make references searchable, comparable, and linkable to invoices and orders.

Payer Name Standardisation

Name standardisation turns “GOOGLE*ADS” or “Google India Pvt. Ltd.” into a single canonical name. The engine strips noise tokens, normalises corporate suffixes, applies fuzzy matching, and uses alias dictionaries. UPI handles resolve to legal entities through merchant registries, which lifts match rates and reduces duplicate masters.

Instrument Mode Tagging

Mode tagging recognizes UPI, IMPS, NEFT, RTGS, NACH, POS, ATM, charges, refunds, FX, loan EMI, and more. These tags power analytics, automate voucher types, and route entries to the correct ledgers. For example, ATM withdrawals to Petty Cash, bank charges to Bank Charges, UPI collections to digital collections tracking.

Match Rate Optimization

Automated matching fuses signals like amount, date windows, standardised names, GSTIN or PAN, and invoice hints, producing a confidence score. High scores auto match, medium scores go to review queues, low scores demand manual intervention.

Typical results: firms move from 40 to 50 percent to 75 to 85 percent auto match, often more with tuned rules.

Implementation in Indian Accounting Systems

Integration with Tally

Tally integration uses enriched fields to pick ledgers, apply GST treatment, and link invoices. Mode tags drive voucher types, so UPI creates Receipt vouchers, NEFT creates Payment vouchers, charges create Journal vouchers, cutting data entry time by up to 75 percent.

Zoho Books Automation

Zoho Books workflows ingest enrichment via API. Contacts map by standardised names, GSTINs update masters, invoice hints enable automatic reconciliation, and UTR or RRN tracking improves receivable tracing and duplicate detection. With enriched conditions, banking rules become far more precise.

Tools and Solutions for Narration Enrichment

AI Accountant

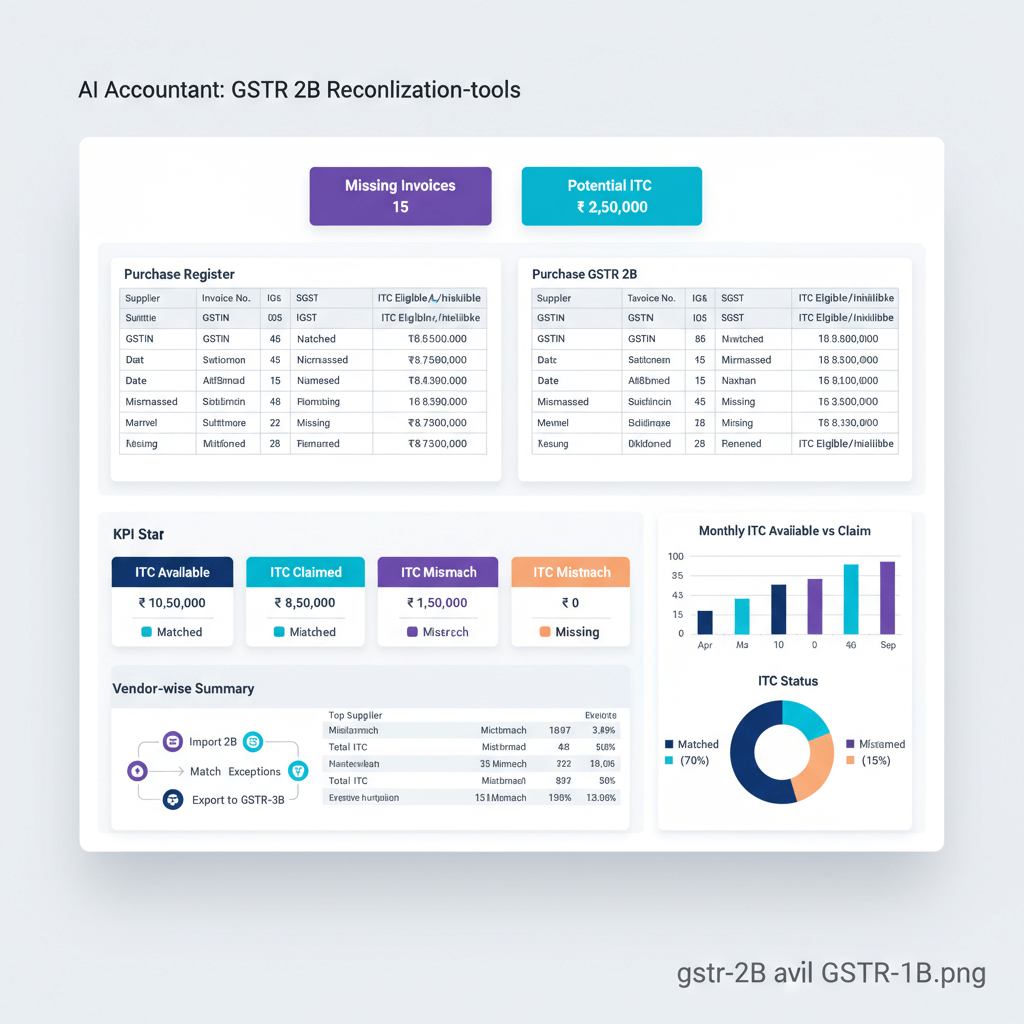

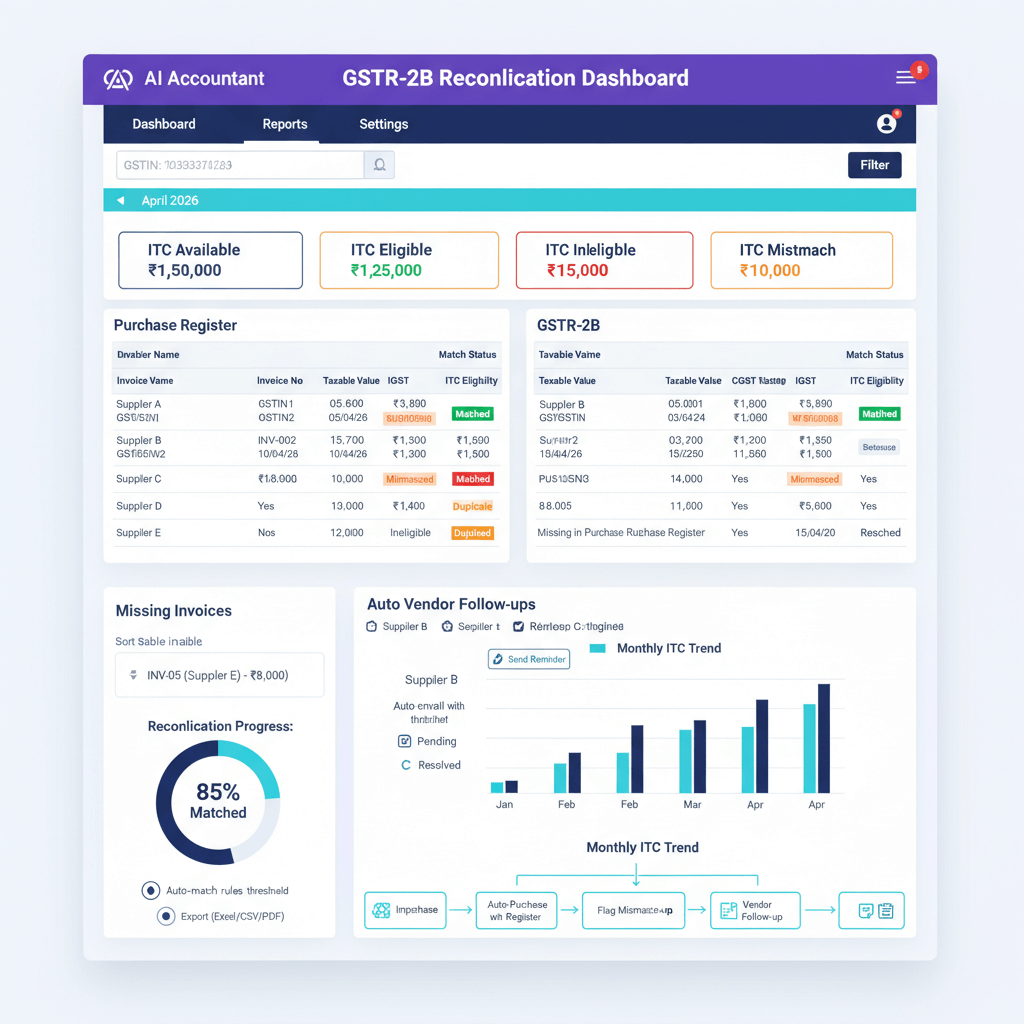

AI Accountant provides India specific enrichment across PDF, CSV, and images from major banks. OCR is tuned for local formats and languages, enrichment runs during parsing, and bi directional sync with Tally or Zoho improves future accuracy. Expect GSTIN validation, name standardisation, UTR or RRN decoding, and robust mode tagging out of the box.

QuickBooks Online

QuickBooks bank feeds deliver basic parsing for vendor names and amounts. It is serviceable for general use, yet lacks India specific GSTIN validation, UTR or RRN extraction, and localized mode recognition.

Xero

Xero learns from categorization and extracts references from common formats. It still misses Indian nuances like GSTIN validation and payment mode patterns that matter for reconciliation depth.

FreshBooks

FreshBooks supports imports with basic text parsing, fine for simple narratives but not for complex Indian formats or multi GSTIN handling and NACH mandate specifics.

Tally Prime with Banking

Tally’s banking module parses some narrations and suggests ledgers, but complex lines still require specialized enrichment to reach high auto match rates.

Real-World Examples and Case Studies

UPI Payment Processing

Raw narration: “UPI/123456789012/vendor.gstin27AABCU1234F1Z5@oksbi/Payment for Invoice INV5678”

Enriched: payer name Vendor Corporation Private Limited, GSTIN 27AABCU1234F1Z5, PAN AABCU1234F, mode UPI, RRN 123456789012, invoice INV5678, confidence 0.95. Tally posts the receipt, links the invoice, and closes out in seconds.

IMPS Transfer Reconciliation

Raw narration: “IMPS-987654321098-ACME CORP-REF45678”

Enriched: payer ACME Corporation Private Limited, GSTIN via master match, mode IMPS, RRN 987654321098, invoice hint REF45678, confidence 0.88. Zoho Books links to the right customer and updates aging.

NEFT with Embedded Details

Raw narration: “NEFT-HDFC0001234N1234567890123456-XYZ LIMITED-INV9012”

Enriched: payer XYZ Limited, UTR HDFC0001234N1234567890123456, issuing bank HDFC, mode NEFT, invoice INV9012, confidence 0.92, delivering a tight audit trail.

Complex Multi Line Scenarios

Raw narrations: 1) “POS 123456 MERCHANT NAME DELHI 15000.00 DR” 2) “CHARGES 180.00 DR” 3) “RFND 15000.00 CR”

Enriched: 1) POS expense 15000 2) Bank charges 180 3) Refund 15000. The net effect zeroes the expense while keeping bank charges in view.

Common Challenges and Solutions

OCR Errors in Scanned Statements

Challenge: low quality scans invert characters and break GSTINs.

Solution: enforce checksum validation, auto correct with a learned dictionary, and flag exceptions for review.

Multiple GSTINs for the Same Vendor

Challenge: one PAN maps to many GSTINs across states.

Solution: prioritize GSTIN, then PAN plus context, maintain a default GSTIN per vendor, and allow quick overrides during review.

Gateway Settlement Narratives

Challenge: Razorpay or Paytm narratives reflect merchant and gateway structures, not customers.

Solution: keep merchant mapping tables keyed by gateway IDs and update regularly, resolve VPAs to legal names when metadata is available.

Bank Specific Format Variations

Challenge: SBI, HDFC, ICICI, Axis all format differently.

Solution: maintain bank specific parsers with tested regex libraries, detect bank type up front, and regression test quarterly.

Partial or Missing Information

Challenge: absent GSTINs, abbreviated names, missing references.

Solution: progressive enrichment in passes, fuzzy match on history, ML scoring with confidence levels that drive review versus auto post.

Best Practices for CA Firms

Setting Up Enrichment Workflows

Begin with your largest volume accounts for fast ROI. Focus on HDFC, ICICI, Axis, and SBI first, then expand. Pilot with 5 to 10 clients, baseline match rates and cycle times, run for a month, then present the delta as your business case.

Training Your Team

Move staff from data entry to exception handling. Teach confidence score thresholds, show how to update alias dictionaries, and document SOPs for different transaction types, with escalation paths for complex cases.

Quality Control Measures

Daily reviews for high value items, weekly trend monitoring for match rates, error logs with root causes, and monthly sampling audits keep quality tight and risk low.

Client Communication

Explain benefits in outcomes, not algorithms. Share dashboards on match rates and cycle time reductions. Set expectations that enrichment removes most routine work, not all work.

Measuring Success

Key Performance Indicators

- Match Rate Percentage: aim 75 percent minimum, 85 percent optimal.

- First Pass Yield: target 70 percent or higher.

- Manual Touch Reduction: expect 50 to 70 percent less effort.

- Reconciliation Cycle Time: cut by at least half.

- Error Rate: keep under 2 percent on auto matched items.

ROI Calculation

Quantify hours saved and multiply by billing rates, add fewer corrections and notices, consider scale gains per accountant, include compliance benefits from clean GSTIN mapping and full reference trails.

Continuous Improvement

Quarterly rule reviews, team feedback loops, industry benchmarking, and investment in historical training data keep performance rising.

Security and Compliance

Data Protection

Prefer solutions with ISO 27001 and SOC 2 Type 2. Use role based access, keep audit trails on enriched fields, and log who changed what and when.

Regulatory Compliance

Accurate GSTINs support GSTR reconciliation. Document enrichment rules for audits, and ensure Indian data residency unless exceptions apply.

Audit Trail Requirements

Store the original narration, applied rules, enriched output, and confidence score. Version control your rule sets, document manual overrides, and preserve historical states for month end reconstruction.

Future of Narration Enrichment

AI and Machine Learning

Models learn from corrections, handle mixed language narratives, and predict reconciliation issues before they hit month end. The system becomes a proactive assistant, not just a parser.

Integration with GSTN

Direct GSTN checks validate GSTINs in real time, automate GSTR matching, and pre build GSTR 1 schedules from enriched transactions.

Real Time Processing

Account Aggregator feeds allow continuous enrichment and reconciliation. Alerts surface unusual patterns or large payments from new vendors instantly.

Predictive Capabilities

Enriched mode and counterparty data power cash flow forecasts and vendor payment schedules, while anomaly detection spots fraud or errors early.

Conclusion

Bank narration enrichment turns bank statement chaos into accounting clarity. For Indian businesses and CA firms, it is no longer optional, it is essential. With 75 to 85 percent automation within reach, firms close faster, reduce errors, and strengthen compliance. Start with high volume accounts, measure the baseline, implement enrichment, then scale once you see the lift in match rates and the drop in cycle time. The future is not about replacing accountants, it is about enriching them with cleaner, smarter, immediately actionable data.

FAQ

How do CA firms practically start narration enrichment without disrupting current reconciliation cycles?

Begin with a pilot on one high volume account per top client, run enrichment in parallel with your current process for one month, compare match rates and hours spent, then switch over once confidence is proven. Tools like AI Accountant allow dual run modes so you can validate before committing.

What match rate should a mid sized Indian CA firm target in the first quarter of deployment?

A realistic target is 70 to 80 percent auto matching within the first quarter, assuming clean master data and focused banks like HDFC, ICICI, Axis, or SBI. With iterative tuning and alias updates, 85 percent is achievable.

How does an enrichment engine validate GSTINs and prevent OCR induced errors in scanned PDFs?

It applies checksum validation on the 15 character GSTIN, cross checks the embedded PAN, and uses a learned correction dictionary to fix common misreads like 0 or O and 1 or I. AI Accountant also flags low confidence extractions for quick review.

What is the recommended confidence score threshold for auto posting versus review?

Many firms use 0.90 and above for auto post, 0.70 to 0.89 for reviewer queues, and below 0.70 for manual handling. You can tune thresholds by transaction type, for example UPI collections may tolerate a slightly lower threshold when GSTIN and invoice hints agree.

How are UTR or RRN references used during audits and dispute resolution?

They serve as your canonical trace IDs. Auditors often sample transactions and request proof, so searchable UTR or RRN fields allow instant retrieval of source payments, linked invoices, and bank confirmations. This shortens audit cycles and reduces back and forth.

How do we handle vendors with multiple GSTINs mapped to a single PAN across states?

Use a hierarchy, match GSTIN when present, else match PAN plus context like invoice hint, amount, and date window. Maintain a default GSTIN per vendor for ambiguous cases, and allow overrides within the reviewer queue for accurate state wise reporting.

Can enrichment reliably standardise payer names from UPI VPAs and gateway settlements?

Yes, with alias dictionaries and gateway merchant registries. AI Accountant resolves common VPAs to legal names and keeps mapping tables for Razorpay, Paytm, and others, which improves duplicate detection and ledger mapping.

What KPIs should partners track to prove ROI to clients and internal stakeholders?

Track match rate percentage, first pass yield, manual touch reduction, reconciliation cycle time, and post enrichment error rate. Present month over month trends and examples of time saved on high volume statements.

How does enrichment improve Zoho Books banking rules compared to vanilla bank feeds?

With standardised names, validated GSTINs, and extracted UTR or RRN, rules can filter by mode and identity, not just amounts. For example, all UPI receipts from GSTIN 27AABCU1234F1Z5 can auto link to Customer ABC and mark invoices paid, which reduces manual verification.

What governance and security controls are expected when processing client bank data?

Look for ISO 27001 and SOC 2 Type 2, role based access, full audit trails of enrichment actions, version controlled rule changes, and Indian data residency. AI Accountant implements these controls and logs field level changes with user stamps.

How should reviewers treat exceptions that repeatedly fail enrichment for the same counterparty?

Create or update alias mappings for that counterparty, confirm the correct GSTIN or PAN, and add pattern rules if the bank narrative is consistent. This turns repeated exceptions into future auto matches, lifting first pass yield.

Can an AI driven system like AI Accountant assist with predictive reconciliation or pre month end alerts?

Yes, by analyzing enriched patterns, it can flag likely mismatches before close, highlight large payments from new vendors for immediate review, and project UPI collections or NACH debits to improve cash planning and reduce last minute surprises.

-01%201.svg)