Key takeaways

- Indian statements are messy, varied, and often low quality, modern intelligent OCR cleans, aligns, and understands them end to end, from low quality PDF cleanup and skew correction, to deep layout understanding and handwriting numeric recognition.

- Accuracy is enforced, not assumed, with balance continuity checks, pattern validation for UTR and IFSC, and Duplicate detection to avoid double posting across files.

- Performance that matters to accountants, 99 percent plus field accuracy on amounts and dates, 95 percent plus complete transaction accuracy on tough scans, 80 to 90 percent reduction in manual typing.

- India specific challenges are first class citizens, passbook handwriting, mixed language content, merged or missing headers, and bank stamps that overlap tables are all handled with context aware extraction.

- Implementation is a journey, start with a focused pilot, codify validation rules, keep a human in the loop, and improve continuously with feedback, confidence scores, and error pattern analysis.

- Evaluate solutions on essentials, noise tolerant extraction, skew correction, numeric handwriting recognition, low quality PDF cleanup, robust validation, and direct integration with Tally and Zoho Books.

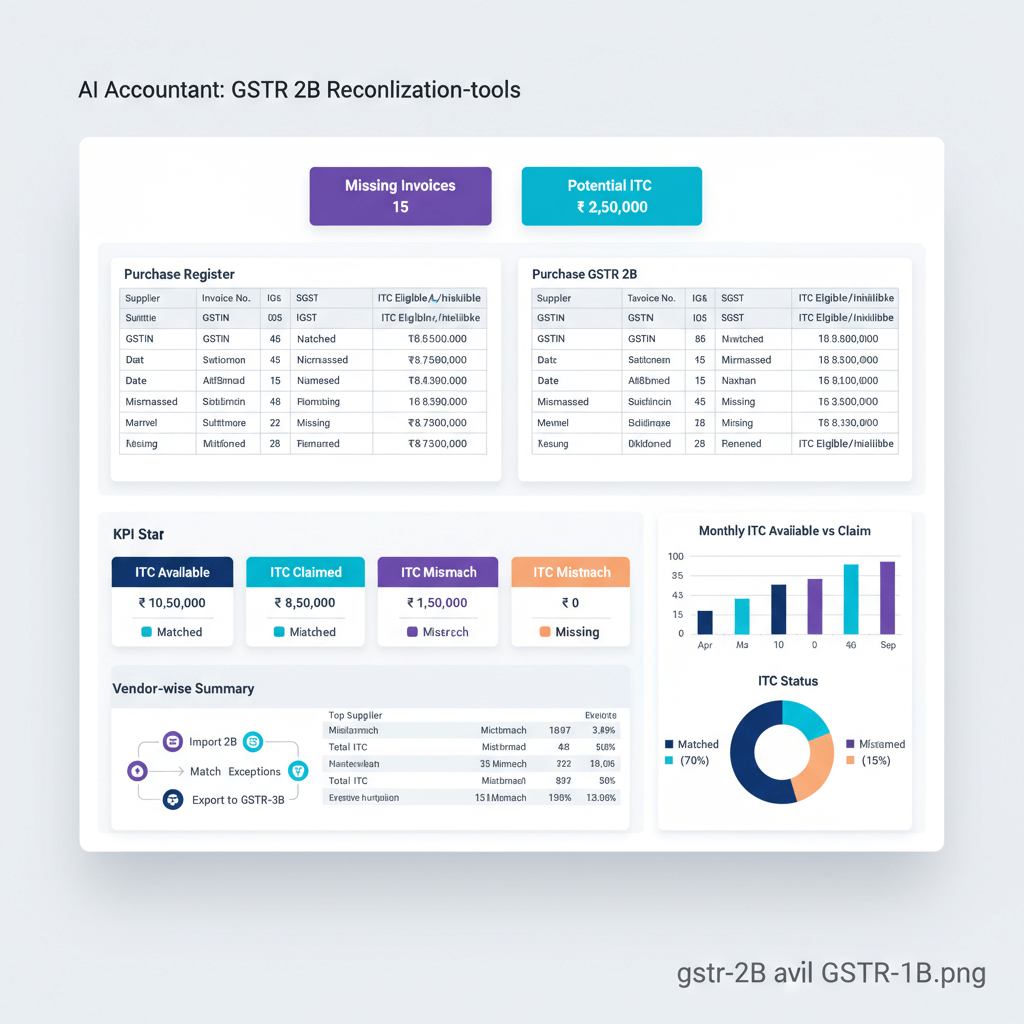

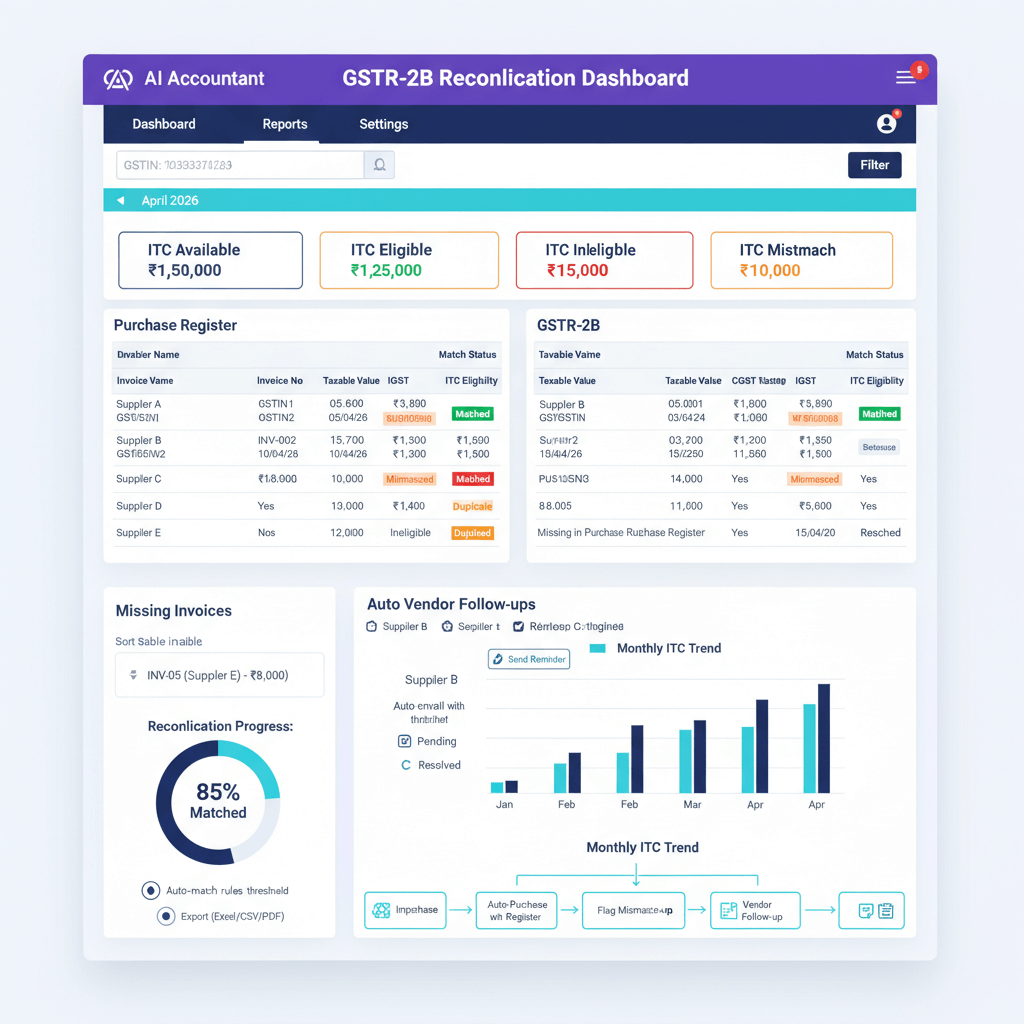

- Purpose built platforms save time, broad bank coverage, ongoing model updates, and prebuilt integrations usually beat in house builds for most firms; tools like AI Accountant deliver fast wins.

Introduction

Every evening, thousands of Indian Chartered Accountants wrestle with scanned bank statements, some stamped, some smudged, many barely readable. Intelligent OCR for scanned bank statements turns these messy PDFs and phone photos into clean, ledger ready data, so your team can spend time on analysis, not typing.

This complete guide shows how modern OCR handles Indian formats, what accuracy and validation to demand, and how to implement a solution that actually reduces work.

If it is not auditable, it is not automation. The right OCR does extraction, validation, and reconciliation readiness, with a full audit trail.

Understanding the Challenge: Why Indian Bank Statements Are So Hard to Digitise

The complexity of Indian banking documents

SBI looks unlike HDFC, Axis narration styles differ from ICICI, PSU and cooperative banks add further variation. Narrations carry UPI references, NEFT, IMPS, RTGS, UTR, and GST notes, which traditional Western focused OCR often misreads or drops.

Document quality obstacles

Low resolution scans, grainy PDFs from older branch scanners, and mobile photos with shadows or perspective distortion are common. Bank stamps and pen marks overlap data, passbooks bring handwritten amounts and ticks that need special handling.

Structural issues in statement tables

Tables split across pages without cues, debit and credit merged into one column, subtotals in merged cells, or even missing headers. Simple text scraping fails, you need systems that understand structure and context.

How Intelligent OCR Actually Works: The Complete Pipeline

Stage 1, Smart input handling

Accept PDFs, images, multipage scans, and password protected files, including image only PDFs. No format juggling for your team.

Stage 2, Advanced image cleanup

Adaptive thresholding revives faint text, deblurring sharpens characters, noise removal and contrast normalization make amounts and dates readable. Low quality PDF cleanup is foundational for accuracy.

Stage 3, Geometric correction and alignment

Skew correction detects edges and lines, normalizes perspective, and aligns text baselines, which is crucial for phone captured or folded pages.

Stage 4, Noise tolerant extraction

Recover tables when stamps hide gridlines, read text under watermarks, and extract despite smudges. The system focuses on what matters, even when humans struggle.

Stage 5, Specialized recognition for handwriting

Numeric handwriting recognition trained on Indian styles captures amounts, cheque numbers in margins, and passbook notes accurately.

Stage 6, Deep layout understanding

Identify Date, Narration, Reference, Debit, Credit, Balance, handle carry forward logic, and adapt when headers are merged or missing.

Stage 7, Data extraction and standardization

Normalize dates to ISO, enforce two decimal precision on amounts, standardize currency and sign, parse UTR, IFSC, and cheque fields into structured data.

Stage 8, Context aware post processing

Language models interpret Indian banking terms, vendor and payee names, and formatting for IMPS, NEFT, UPI, and GST. Bank specific dictionaries help parse narrations correctly, improving categorization and matching.

Critical Validation Rules That Ensure Accuracy

Mathematical verification

For each row, previous balance plus credits minus debits must equal next balance. Date monotonicity, correct page carry forwards, and impossible value flags stop errors before they reach your books.

Pattern checks and anomaly detection

Duplicate detection prevents resubmitting the same statement, amount sanity checks catch sign flips, outlier detection flags large entries, and reference validation enforces UTR and IFSC formats, with proper masking for card and cheque numbers.

Table structure integrity

Consistent column counts, reconnection of split rows, and flags for blank or suspicious fields ensure structural soundness.

Reconciliation readiness

Automatic matching against invoices and bills, confidence scores that guide reviewers, and a complete audit trail of corrections and approvals keep you compliant and efficient.

What gets validated gets trusted.

Measuring OCR Performance: Metrics That Matter

Field level accuracy

Amounts and dates should exceed 99 percent accuracy, narrations and balances should be near perfect, otherwise OCR creates rework.

Holistic transaction accuracy

A transaction is only useful if every field is correct. Leading systems deliver 95 percent plus fully correct rows, even on tough scans.

Operational efficiency gains

Balance continuity pass rate, recall on dense small value tables, and processing time per page show the real value. Target an 80 to 90 percent reduction in manual effort.

Solving India Specific Edge Cases

Handwritten passbooks

Indian numerals and regional variants require dedicated models, plus removal of stamps and seals without losing data.

Multilingual statements

Handle Hindi numerals with English text, and regional scripts without losing accuracy.

Complex table variations

Reconnect split tables across pages, parse merged debit credit columns, infer missing headers from context, and link carry forward rows reliably.

Specialized transaction types

Identify GST payments, classify loan EMI entries, parse foreign exchange lines, and mark TDS deductions correctly.

Mobile photography challenges

Deskew, shadow removal, perspective correction, and compression artifact handling protect accuracy on phone captured documents.

Converting OCR Output into Accounting Value

Automated ledger classification

Map narrations to ledgers, assign GST codes, detect vendors, and learn from history to improve future classification.

Direct accounting system integration

Push entries to Tally, sync with Zoho Books, fetch open bills for matching, and post clean entries automatically.

Real time financial visibility

Dashboards highlight flows, refunds, and anomalies, cash flow views update instantly, and reconciliation status is always visible.

Human in the loop

Low confidence items route to reviewers, corrections feed model improvement, and approvals ensure quality with traceability.

Build vs Buy: Making the Right Choice

When building in house can work

If you only process one or two formats, have a strong ML team, and strict internal security needs, building can be viable, though most find it overwhelming over time.

Why specialized solutions win

Broad bank coverage, constant model updates, and prebuilt Tally and Zoho Books integrations save months. Bulk processing and mixed quality documents are handled gracefully. Security certifications like ISO 27001 and SOC 2 provide assurance, and setup is fast.

Key features to evaluate

- Noise tolerant extraction, for real world scans

- Skew correction, for photos and folded pages

- Numeric handwriting recognition, for passbooks and annotations

- Low quality PDF cleanup, for faint or grainy text

- Robust validation rules, to enforce accuracy before posting

Security and Compliance Considerations

Data protection standards

Encrypt at rest and in transit, look for ISO 27001 and SOC 2 Type 2, and confirm data life cycle controls.

Access control and audit trails

Role based permissions, least privilege access, complete audit logs, and regular security reviews protect sensitive financial data.

Implementation Best Practices

Start with a focused pilot

Pick five to ten high volume bank formats, build a test library of poor scans, and iterate quickly with user feedback.

Codify validation early

Block posting when balance fails, track per field confidence, route low confidence items to review, and build narration to ledger mapping memory.

Continuous improvement loop

Monitor accuracy by bank and scan type, analyze error patterns, update rules based on real cases, and expand automation gradually as confidence grows.

Recommended Tools and Solutions

When evaluating bank statement digitisation tools, consider these options:

- AI Accountant — Built for Indian businesses, with bank trained OCR, direct Tally and Zoho Books integration, automated ledger mapping, and comprehensive validation rules.

- QuickBooks — Basic statement import for simpler needs.

- Xero — Bank feed integration with basic OCR, Indian bank support varies.

- FreshBooks — Expense scanning and basic processing, suitable for freelancers.

- Zoho Books — Native Indian banking integrations and automation for SMBs.

The Future of Bank Statement Processing

Account aggregator frameworks will enable direct feeds, GSTN integration will automate tax reconciliation, and predictive analytics will flag cash flow risks early. As models learn from every processed statement, error rates drop continuously, and manual reviews shrink.

Taking Action: Your Next Steps

Assess where time is wasted today, identify the most troublesome banks and formats, define accuracy and compliance needs, then evaluate solutions for noise tolerance, skew correction, handwriting numeric recognition, low quality PDF cleanup, and strong validation. Start a pilot, measure time saved and error reduction, then scale.

Conclusion

Manual entry of bank statements is tedious and risky. With Intelligent OCR for scanned bank statements, Indian firms can process poor scans, enforce validation, and integrate directly to ledgers. From cleanup and skew correction to handwriting numeric recognition and balance checks, the technology exists today to transform your workflow. Adopt the right solution, and trade late night typing for strategic work that grows your practice.

FAQ

Can intelligent OCR really handle mobile photos with shadows and angles for SBI or HDFC statements?

Yes, with proper cleanup, deskew, and perspective correction, modern OCR reads mobile photos reliably. In practice, tools like AI Accountant apply adaptive thresholding, shadow suppression, and baseline alignment to recover dates, narrations, and amounts even when photos are taken at awkward angles.

How do I guarantee running balance continuity across pages when banks split tables oddly?

Enforce a rule that previous balance, plus credits, minus debits must equal next balance, then verify carry forward lines at every page break. AI Accountant performs row by row checks and page transition validation, and it blocks posting if any row fails the balance equation.

Is handwriting recognition trustworthy for passbooks that include manual amounts and ticks?

When scans are clear, Indian tailored numeric models achieve high accuracy on handwritten amounts and cheque numbers. Best practice is to combine handwriting numeric recognition with confidence scoring, so any low confidence cell routes to a reviewer queue. AI Accountant follows this human in the loop approach.

How do I validate UTR and IFSC patterns at scale across thousands of transactions?

Use pattern libraries for UTR length and structure, and RBI compliant IFSC regex checks, then cross reference narrations. AI Accountant applies reference validation rules during extraction, flags mismatches, and links suspect rows to quick review.

Will OCR handle merged debit and credit columns or missing headers in PSU bank statements?

Yes, with deep layout understanding. The system learns column roles from context, splits merged cells, and infers missing headers by analyzing row patterns and arithmetic consistency. This is standard in AI Accountant’s layout engine.

How does duplicate detection work when clients resend the same statement PDF in a new email?

Compute content hashes on normalized tables, not on raw files, and compare date ranges and opening or closing balances. Duplicate detection in AI Accountant prevents reprocessing across files, and it flags overlapping periods for review.

Can an OCR platform process password protected or image only PDFs without manual conversion?

Yes, specialized systems unlock protected PDFs during intake, and run full OCR on image only documents. AI Accountant supports both, so you do not need to re save or remove passwords beforehand.

What accuracy metrics should a CA demand before putting OCR into production?

Target at least 99 percent accuracy on amounts and dates, 95 percent plus complete transaction accuracy, balance continuity pass rates above 98 percent, and an 80 to 90 percent reduction in manual keystrokes. Ask vendors, including AI Accountant, to report these by bank and scan type.

How does intelligent OCR map narrations to ledgers and vendors in Tally automatically?

Use bank specific dictionaries, n gram models, and vendor extraction to predict the ledger, then learn from corrections. AI Accountant builds a narration to ledger memory per client, applies GST rules, and posts to Tally with audit trails.

What is the best pilot plan for a mid sized firm with mixed quality scans?

Pick five to ten high volume banks, assemble a test pack of clean and poor scans, define success thresholds for accuracy and time saved, and run a two week trial with reviewers. AI Accountant’s pilot playbook follows this approach, delivering measurable wins quickly.

How do I keep auditors comfortable with OCR driven workflows?

Maintain an immutable audit trail of every extraction, validation, correction, and approval. Enforce role based access and export reviewer logs on demand. AI Accountant records field level changes with timestamps and users, which auditors appreciate.

Can I reconcile entries against open invoices in Zoho Books during extraction?

Yes, by fetching open invoices and bills, matching on vendor, amount, and date windows, and scoring the match quality. AI Accountant performs this during validation, flags ambiguities, and lets reviewers confirm before posting back to Zoho Books.

-01%201.svg)