Key takeaways

- Indian CA firms can cut onboarding time by 35 percent and review comments by 40 percent with a structured knowledge management system, as multiple studies indicate Source Source.

- Centralize SOPs, templates, and workpapers in a searchable, versioned repository, use clear naming conventions, and enforce metadata tags for rapid discovery.

- Adopt a governance model with defined owners, reviewers, and review cadences, ensure maker checker workflows and immutable audit trails.

- Start with quick wins, a master monthly close checklist, a standardized bank reconciliation template, and an auto indexed challan library.

- Leverage AI for OCR, auto classification, and workflow routing, tools like AI Accountant integrate with Tally and Zoho Books to automate data capture and reconciliation.

- Track KPIs that matter, search to find time, rework rate, month close duration, filing accuracy, and training completion, to prove ROI and drive adoption Source Source Source.

Why your CA firm needs a knowledge management system now

Many Indian CA firms are drowning in files, SOPs, and updates, a robust knowledge management system transforms scattered documents into repeatable, review ready workflows. New article trainees join frequently, GST rules change overnight, client documents sit across WhatsApp, email, and personal drives, while partners demand speed and accuracy. The solution is not more effort, it is smarter systems.

Staff turnover is relentless. Without systems, seniors repeat training, and departing team members take tacit knowledge with them. Regulatory change is constant. GST, TDS, UDIN, and portal updates create weekly complexity. Tech stacks vary by client. Tally, Zoho Books, GST portal downloads, IT acknowledgements, all require consistent processes. Clients expect speed and documentation on demand.

A well designed knowledge management system centralizes firm wisdom, accelerates training, reduces errors, and keeps compliance content current. Research shows significant gains Source Source. The benefits extend beyond efficiency, better decisions, stronger collaboration, and durable competitive advantage Source Source Source.

The firms that document learn faster, onboard faster, and review faster, turning every job into a reusable playbook.

Core components every knowledge management system needs

Document repository accounting, your digital filing cabinet

Your repository is the firm’s spine, every client workpaper lives here, searchable, versioned, and secure. Use OCR to read scans, capture PAN, GSTIN, FY, form type, and status metadata automatically. Track prepared, reviewed, approved states, with complete user history. Integrate with Tally and GST portals to reduce manual work.

Template library CA, standardization at scale

Standardize engagement letters, GST reconciliation formats, KYC checklists, PBC lists, bank reconciliation templates, TDS return workflows, and client onboarding steps. Current, tested, and approved templates eliminate guesswork, reduce training time, and ensure compliance.

Best practices database, learning from experience

Capture SOPs, post mortems, regulatory interpretations, and resolved review comments. Convert individual learning into organizational wisdom, so new team members avoid old mistakes, and seniors share expertise without constant interruption.

Training materials management, building competence systematically

Create role based curriculums, microvideos of real processes, annotated screenshots, and assessments. Track completion and scores, identify gaps before they hit clients Source.

Information architecture that actually works

Folder structure and organization

Use a simple, scalable hierarchy, Firm, Client, Financial Year, Engagement Type, Workpaper Set, Supporting Documents. Keep subfolder names consistent across clients, standardize engagement type categories, and use uniform workpaper sets.

Naming conventions that scale

Adopt a consistent file name format, Client_GSTIN_FY_Period_DocType_Version_PreparedBy_ReviewedBy_Date. Example, ABC_27AABCA1234B1Z5_FY2024_Q1_BankReco_V2_RahulSharma_PriyaPatel_15042024. It is long, yet searchable and self documenting.

Metadata tags for smart search

- Client identifiers, GSTIN and PAN

- Time markers, financial year and period

- Status, draft, prepared, reviewed, approved

- Form type, GSTR-1, 26AS, ITR

- Sensitivity, public, internal, confidential

Search by status, period, and form type to find exactly what you need, fast.

Retention policies and compliance

Build in India specific retention, seven to eight years for most documents. Set auto archival rules, approval based disposal, and full deletion audit trails. Keep permanent records forever, while routine correspondence follows statutory periods.

Process design and governance framework

Content lifecycle management

Every asset follows, Capture, Curate, Classify, Publish, Review, Retire. Publish only after validation, review on cadence, and retire outdated content systematically.

RACI matrix for knowledge ownership

- Knowledge Owner, creates and maintains content

- Reviewer, validates accuracy and completeness

- Librarian or Admin, enforces standards and structure

- Users, apply knowledge in delivery

Example, the GST expert owns GST templates, a partner reviews quarterly, the knowledge manager ensures filing discipline.

Review cadence and quality control

- Weekly, regulatory notifications

- Monthly, process documents

- Quarterly, template and SOP refresh

- Annually, complete system audit

Use maker checker workflows, track changes, and maintain version histories.

Access control and security

Apply least privilege and strict client segregation. Use time bound shares for client portals, enable two factor authentication, log all access, and monitor anomalies.

Choosing the right tools for your firm

Tool categories and options

- Document management, Google Drive, OneDrive, SharePoint, evaluate search, OCR, version control.

- Wiki or knowledge base, Confluence, Notion, Zoho Wiki, evaluate authoring ease and template support.

- Practice management, Zoho Practice and CA specific tools, evaluate workflow and client coordination.

- Accounting integration, Tally, Zoho Books, QuickBooks, evaluate APIs and sync quality.

- AI enhancement, OCR and auto tagging, evaluate accuracy and Indian format support.

Deep dive on task and deadline tools for CA firms.

Selection criteria checklist

Search and discovery

- Full text search in PDFs and images, OCR for scans, advanced filters

Version control and audit

- Automatic versions, complete audit trails, rollbacks

Security and compliance

- Role based access, SSO and 2FA, India data residency, ISO or SOC certifications

Integration capabilities

- APIs to accounting software, GST and IT portals, email and calendar

Usability and support

- Intuitive UI, mobile access, local support, migration tools

Cost considerations

- Per user pricing, storage limits, admin overhead, scaling costs

Recommended accounting automation tools

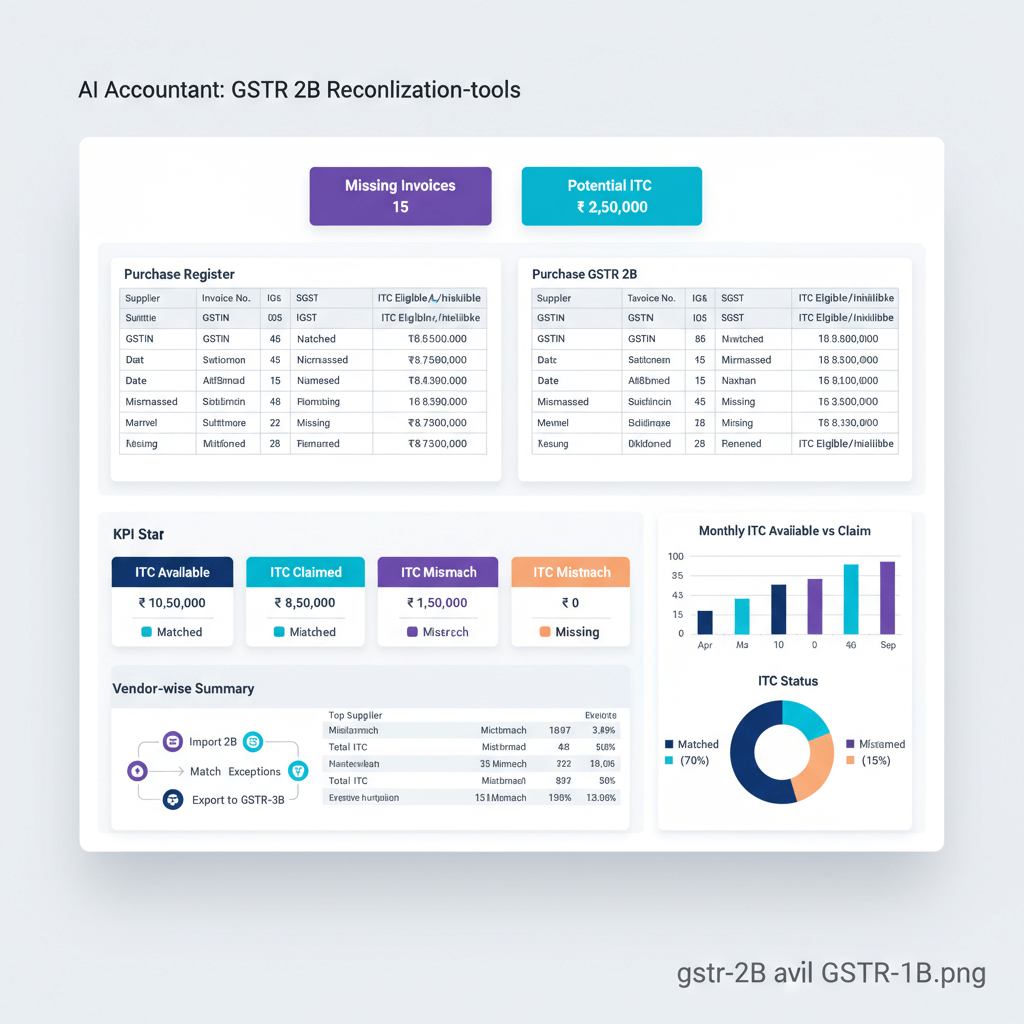

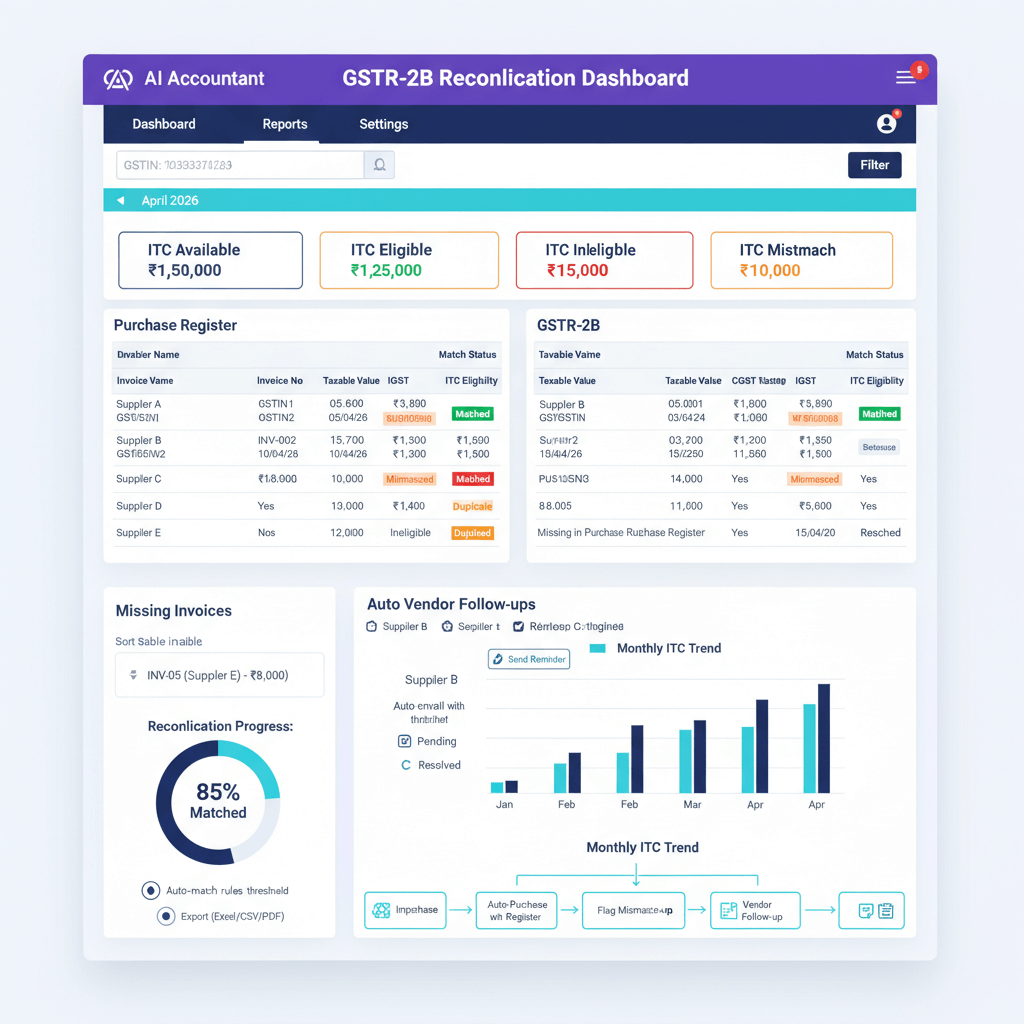

- AI Accountant, automates bookkeeping and reconciliation with OCR for Indian bank formats, Tally and Zoho integration, automated dashboards.

- QuickBooks Online, cloud accounting with document attachments and basic automation.

- Xero, strong document management and third party integrations.

- FreshBooks, simple projects and file organization for smaller firms.

- Zoho Books, GST ready with native storage and workflow automation features.

Building your document repository accounting system

Implementation best practices

Do these things

- Enforce naming conventions at upload, do not rely on memory.

- Run auto OCR on every document, let technology read Indian bank statements, GST returns, and even handwritten notes.

- Deduplicate aggressively, establish single sources of truth.

- Link workpapers to ledger entries for instant drill through during reviews.

Avoid these mistakes

- Never mix client data in shared folders, segregation is mandatory.

- Do not park knowledge on personal drives or WhatsApp.

- Never skip versioning, you must know who changed what and when.

Quick wins to start with

- Master month end close checklist, one definitive list of steps, reports, and reconciliations, updated monthly.

- Standardized bank reconciliation format, one template for all clients, firm wide training.

- Auto indexed challan library, scan and tag by assessment year, tax type, and amount, then retrieve in seconds.

Creating your template library CA

Essential templates to build first

Engagement and compliance

- Engagement letters, KYC checklists, client onboarding workflows, disengagement procedures

GST templates

- Monthly GST reconciliation, GSTR-1 vs books, GSTR-2B matching, input tax credit trackers

Income tax templates

- TDS return preparation, advance tax calculators, tax audit workpapers, assessment responses

Routine compliance

- Bank reconciliation statements, fixed asset registers, statutory payment trackers, compliance calendars

Template governance system

Assign owners for categories, show last reviewed dates, keep change logs with regulatory references, and maintain version control with the last three versions readily accessible.

Developing your best practices database

Capturing institutional knowledge

Use a consistent entry structure, problem statement, context, solution steps, evidence, outcome, and tags. This makes entries comparable and searchable.

Making knowledge sharing happen

Run monthly brown bag sessions, record them, and upload to your training library. Create contributor leaderboards and recognize documentation champions. Build ready to use patterns for recurring issues like GST mismatches or TDS certificate delays.

If a solution helped one team once, it should help every team forever.

Scaling through training materials management

Building role based learning paths

- Article trainees, basics of accounting, Tally and Excel navigation, document protocols, communication basics

- Associates, complex reconciliations, GST returns, basic tax computations, review procedures

- Seniors, advanced planning, client relationships, team supervision, quality review techniques

Creating effective training assets

- Video tutorials, real software, common errors and fixes, under ten minutes

- Annotated SOPs, screenshots with callouts, critical fields highlighted

- Practice datasets, sanitized data with seeded errors for detection drills

- Assessments, scenario based quizzes with score tracking

Tracking training effectiveness

- Completion rates, assessment score trends, time to productivity, error rates before and after training, and peer review feedback

Use these insights to refine curricula continuously Source.

Your 30-60-90 day implementation roadmap

Days 0 to 30, foundation building

Week 1, tool selection, assess current systems, demo three to five platforms, check integrations, confirm budget and buy in.

Week 2, taxonomy design, define folder structures, naming conventions, metadata schemas, and classification rules.

Week 3, team preparation, appoint knowledge owners, assign governance roles, create admin accounts, schedule training.

Week 4, initial migration, move two to three pilot clients, seed templates, upload core SOPs, test access controls.

Days 31 to 60, systematic rollout

Week 5 to 6, process documentation, document top workflows, create quick references, build search tutorials, design feedback forms.

Week 7 to 8, broader migration, move a quarter of clients, enable permissions, run hands on training, gather feedback.

Days 61 to 90, full implementation

Week 9 to 10, complete migration, move remaining clients, archive old systems, update client communications, implement backups.

Week 11 to 12, optimization, launch KPI dashboards, set governance calendar, collect improvements, plan quarterly reviews.

Measuring success, KPIs and ROI metrics

Efficiency metrics

- Search to find time, target under two minutes for any document

- Rework rate, reduce by forty percent

- Review comments per job, track monthly improvement

- Month close duration, reduce by thirty percent in six months

People metrics

- Onboarding time, improve by fifty percent

- Training completion, target ninety percent on time

- Knowledge contributions, count documents, templates, and solutions added

- Billable utilization, more time serving clients, less time searching

Compliance metrics

- Filing accuracy, fewer GST and IT notices

- Audit observations, reduced queries

- Document availability, one hundred percent retrieval in inspections

- Version currency, templates updated within forty eight hours of changes

Common pitfalls and how to avoid them

Over engineering your taxonomy

The problem, too many folder levels and complex names nobody follows. The solution, start simple, three to four levels, add complexity only when needed.

Poor tagging discipline

The problem, inconsistent tags break search. The solution, controlled vocabulary, limited tag creators, regular audits.

Unmanaged personal drives

The problem, critical content trapped in personal folders. The solution, audits, auto migration prompts, clear policy on shared storage.

Lack of ownership

The problem, stale SOPs and templates. The solution, assign owners with KPIs, include KM in reviews, celebrate contributors.

Ignoring change management

The problem, users resist new systems. The solution, involve users early, provide hands on support, and share success stories.

Where AI powered tools fit your knowledge system

Automation opportunities

Intelligent document processing, AI reads Indian bank statements, GST returns, and invoices, extracts data and classifies documents. Smart classification, ML predicts folders and tags, suggests related documents, and flags missing workpapers. Automated workflows, AI routes reviews, flags anomalies, and recommends next steps.

Integration with existing systems

Tools like AI Accountant bridge document management and accounting, ingest any bank statement format, classify transactions, and sync with Tally and Zoho Books. Automated dashboards reveal revenue and cash insights without manual work, feeding your best practices database with real performance data. Future capabilities include GSTN return matching, direct bank feeds, and predictive analytics for working capital.

Security, compliance, and client trust

Building a secure foundation

Enforce role based access, SSO, strong passwords, and universal 2FA. Log every access and change, and Make logs immutable. Encrypt data at rest and in transit, separate keys, and test recovery quarterly.

Compliance posture

Keep Indian data within India, verify data center locations, and understand cross border implications. Prefer ISO 27001 and SOC 2 Type 2 certified vendors. Maintain strict client segregation using folders, permissions, and isolated encryption strategies.

Building client confidence

Be transparent about security policies, share certifications, and provide audit reports when requested. Use NDAs and data protection clauses, define incident response procedures, and communicate breaches immediately if they occur Source.

Practical resources and templates

Quick start toolkit

- Taxonomy cheat sheet, one page guide to folders, names, and tags

- Starter template bundle, twenty essential engagement and compliance templates

- Governance calendar, quarterly schedule for reviews and training

- Contributor guide, simple rules and examples for adding content

Implementation checklist

- Tool selection completed

- Budget approved

- Team roles assigned

- Taxonomy documented

- Pilot clients migrated

- Templates uploaded

- Training conducted

- Feedback collected

- KPIs defined

- Governance calendar set

Moving forward with confidence

Building a knowledge management system is now survival equipment for CA firms. Start small, pick one client or process, create your first template, document your first SOP, and compound improvements each week. Consider how automation accelerates outcomes, tools like AI Accountant handle OCR, classification, and reconciliation, while your team focuses on high value knowledge and review.

The path from document chaos to knowledge mastery is clear, the tools exist, and the benefits are proven. Act first, implement systematically, and evolve continuously. Your firm’s knowledge system becomes a durable advantage, one that remembers everything, shares wisdom instantly, and drives consistent quality.

FAQ

How do I start a knowledge management system in a small CA firm without a full time ops team

Start with free or existing tools like Google Drive, define a simple folder structure, create core templates, and assign part time knowledge champions. Dedicate two to three hours weekly for maintenance, measure quick wins like retrieval time and review comments to build momentum.

What naming convention should we enforce so reviewers can locate files quickly during audits

Use a consistent scheme, Client_GSTIN_FY_Period_DocType_Version_PreparedBy_ReviewedBy_Date. Example, ABC_27AABCA1234B1Z5_FY2024_Q1_BankReco_V2_RahulSharma_PriyaPatel_15042024. Enforce at upload with validation, do not rely on memory.

How can we migrate a messy Google Drive where client data is mixed and duplicates exist

Adopt a greenfield approach for new files using the new structure, migrate high value documents first like current year workpapers and active client folders, quarantine old archives, and deduplicate using checksum tools. Phase cleanup during low workload periods.

What metrics should partners track in the first 90 days to prove ROI to the team

Track search to find time, review comments per job, month close duration, and new hire time to productivity. Aim for two minute retrievals, twenty five percent fewer comments, thirty percent faster closes, and thirty to fifty percent faster onboarding.

How do we keep templates and SOPs current with frequent GST and TDS changes

Assign owners, set a quarterly review cadence, maintain change logs with regulatory references, and alert users to updates. Use maker checker approvals so no template goes live without review, and target updates within forty eight hours of regulatory changes.

What is the fastest way to standardize bank reconciliation across all clients

Create a single firm wide bank reconciliation template, train all staff, and automate data ingestion with OCR. Tools like AI Accountant can read Indian bank statements, push standardized outputs, and link workpapers to ledger entries for reviewers.

How do we ensure client wise segregation and access control without slowing the team

Map roles to least privilege access, use client specific groups, and enable time bound sharing for exceptions. Implement SSO and 2FA, and run quarterly access reviews to keep permissions clean.

What is the best way to capture tacit knowledge from seniors before they roll off

Run short recording sessions where seniors walk through real cases, capture SOPs with annotated screenshots, and log edge cases as best practice entries. Incentivize contributions with recognition and include knowledge sharing in performance goals.

Which AI features create immediate value for a CA firm’s knowledge system

OCR for Indian bank formats, auto classification of GST and IT documents, duplicate detection, and anomaly flags for review. For example, AI Accountant extracts data from bank statements, classifies documents, and routes workpapers for maker checker review.

How do we handle offline clients that send physical papers or scans

Scan everything on receipt, use mobile scanning when needed, OCR all files, and maintain a physical document log for storage locations. Run a hybrid model during transition and aim for digital as the primary record within one to two quarters.

What governance structure prevents the knowledge base from becoming stale again

Define RACI for each content area, publish a governance calendar, run monthly content audits, and include knowledge KPIs in appraisals. Use dashboards to track last updated dates and content usage, then cull or refresh low use content.

How can we reduce GST and IT notices with better knowledge management

Use standardized reconciliation templates, maintain updated checklists, and track filing accuracy as a KPI. Automated tools like AI Accountant help match returns to books, highlight variances, and keep evidence ready for assessments, which reduces notice rates and improves audit readiness.

-01%201.svg)